Second waves and diminishing second chances

In November 2016 when presidential candidate Donald Trump and his Republican

party surprised markets & the world with a clean sweep of the White House and both chambers of Congress it was clear a new age of protectionist strongman politics was here. Fast forward 38 months to the start of another election year and queue the first recorded case of Covid-19 in the state of Washington by a man who had returned from Wuhan on 15 January 2020.

At this point the coronavirus was not perceived as a deadly pandemic threat by global investors, the White House, nor indeed the World Health Organisation, and was largely written off as another benign epidemic that would be extinguished by strict Chinese containment measures in a city far away.

The problem with complacency is that it breeds complacency. Following a very strong 2019 for global markets, remembered now as the year of the “Everything Rally” where most financial markets posted stellar returns, overconfidence and an underappreciation of growing risks prevailed. Nowhere more so than in the White House, where President Trump was planning his re-election year with his poll ratings riding high and democratic nominee candidates scrambling for momentum.

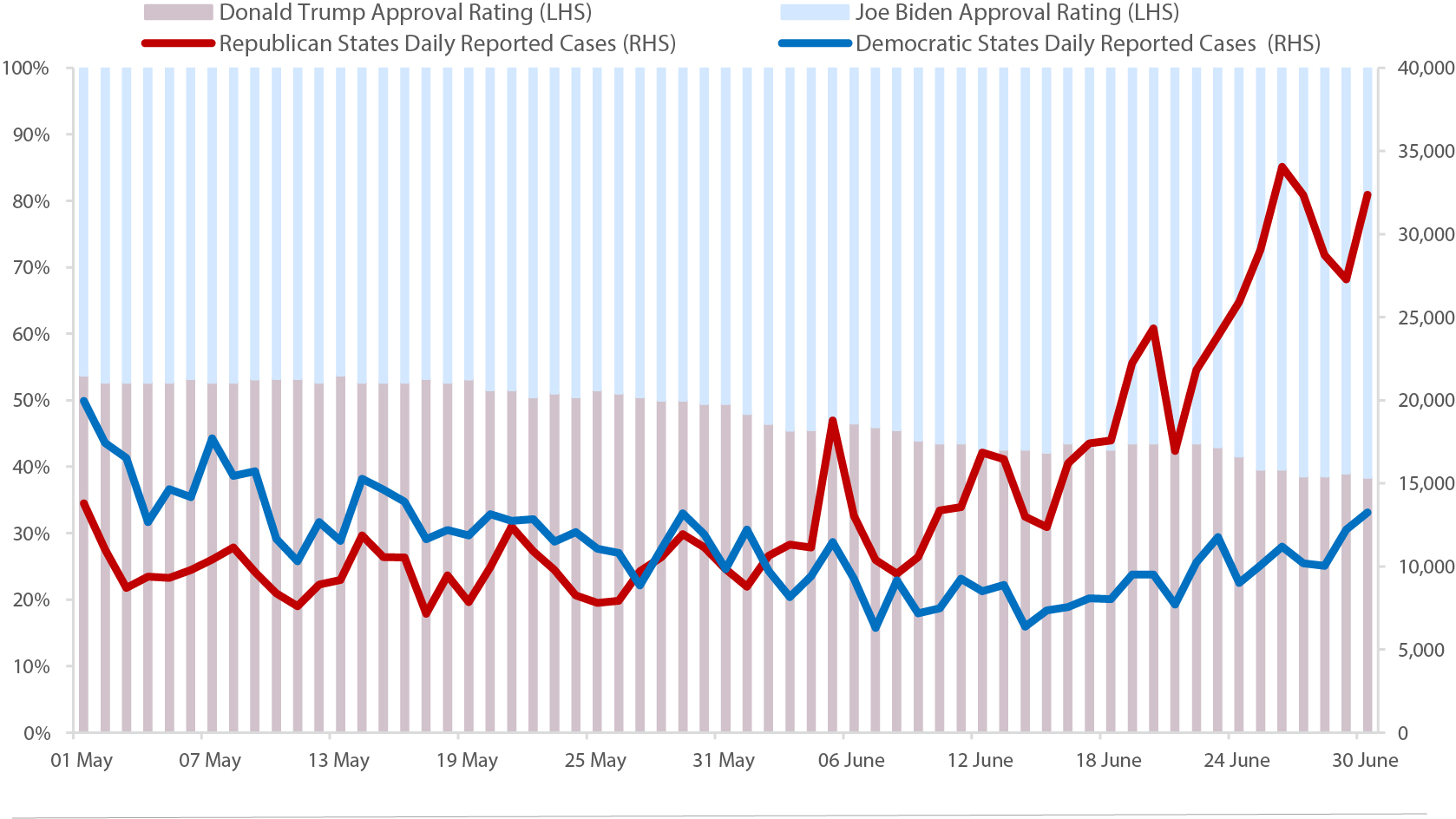

The first wave of coronavirus infections was unevenly spread across America, hitting north eastern states and in particular Democratic-leaning New York disproportionally harder, where new infection numbers hit nearly 12,000 cases per day in April, contributing to roughly one third of the total daily cases reported across the country.

The second wave started in June shortly after lockdown restrictions were lifted across America, however this time it is different with the sunbelt states across the south suffering the worst. Republican states that had voted for Trump in 2016 and had seen protests against coronavirus lockdown restrictions during the first wave, are now registering a painful second wave of infections at a rate of 30,000+ cases per day and rising. The trend across Democratic states, however, has been starkly lower, where cautiousness and the adoption of face masks have been more prevalent. As the US reaches 3 million cases, and with Republican states Texas and Florida surpassing New York’s record for daily new cases, it is not surprising that Democratic nominee Joe Biden has now garnered a commanding lead in the polls over President Trump of 62% versus 38%.

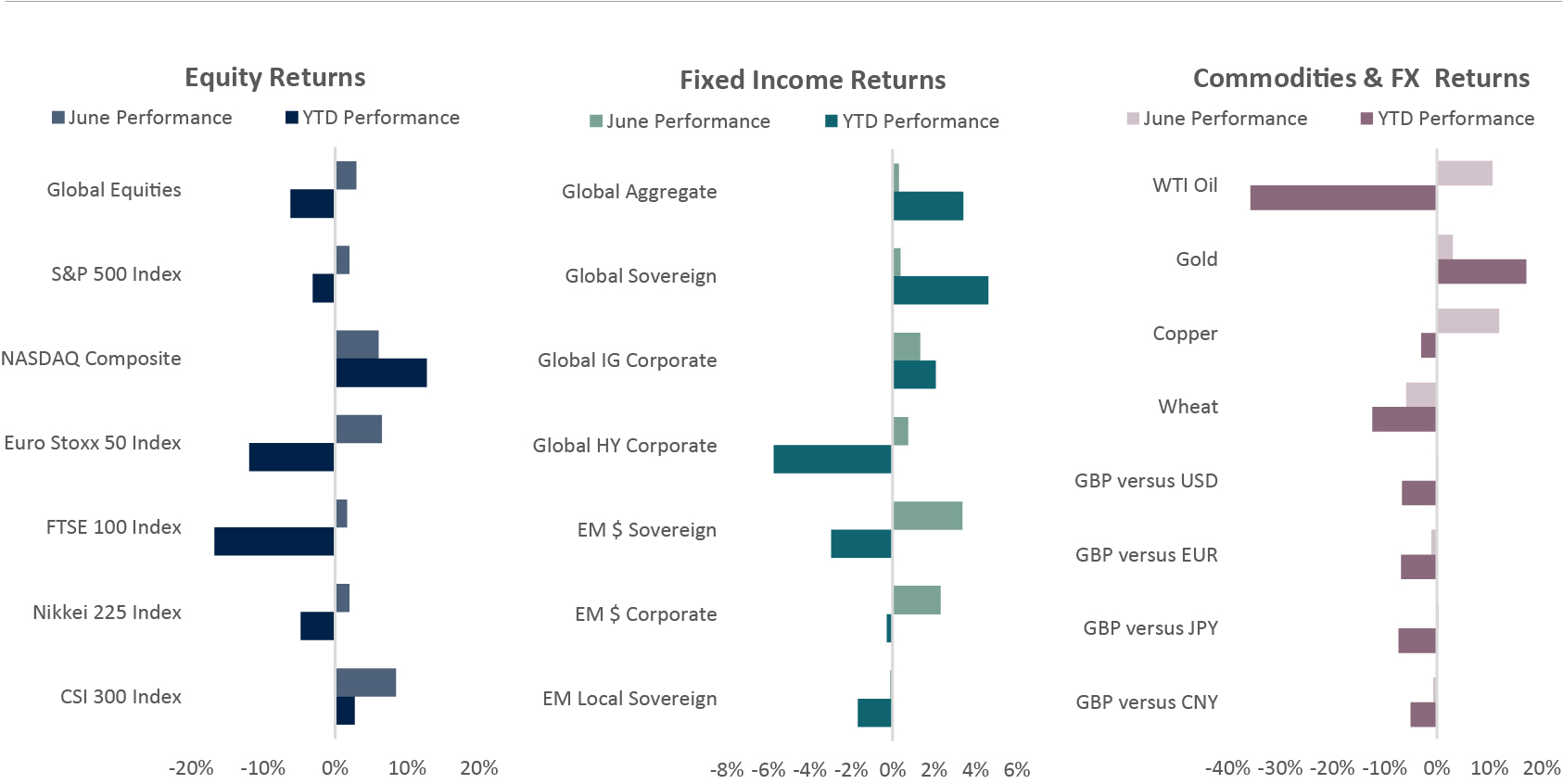

Source: Signia Wealth, Bloomberg. Data as at 30/06/2020. Global Equities: iShares MSCI ACWI ETF; Global Aggregate: Vanguard Global Bond Index GBP Hedged Fund; Global Sovereign: Xtrackers Global Government Bond GBP Hedged ETF; Global IG Corporate: Vanguard Global Corporate Bond Index GBP Hedged Fund; Global HY Corporate: iShares Global High Yield Corporate Bond GBP Hedged ETF; EM$ Sovereign: iShares J.P. Morgan USD EM Bond ETF; EM$ Corporate: iShares J.P. Morgan USD EM Corporate Bond ETF; EM Local Sovereign: iShares J.P. Morgan EM Local Government Bond ETF.

Equities

• Emerging market and Asian equity indices strongly outperformed during June, with a weaker US dollar and looser financial conditions buoying investors.

• European markets recorded the next best returns, as improving economic data and better control over coronavirus helped support sentiment.

• US bourses posted decent positive returns, with better economic data and policy easing offsetting sharp rises in coronavirus cases in the country.

• UK and Japanese markets lagged the rest of their peers, as concerns of the economic impact of coronavirus weighed on both.

Jack Rawcliffe

Fixed Income

• Global Sovereigns were close to flat on the month, as improving risk sentiment led to a risk-on month with investors choosing to allocate mostly to risk assets over safe-haven assets.

• Global Corporate Credit rallied on the back of growing risk appetite, improving oil prices, and continued loose monetary and fiscal stimulus globally.

• Emerging Market Debt indices were among the best performing fixed income indices this month, benefitting from the pickup in activity from easing of lockdowns despite pockets of flareups in COVID19 cases. Hard Currency Dollar Denominated Debt was the top performing of the three EM indices.

Grégoire Sharma

Commodities & FX

• WTI Crude Oil appreciated over 10% as global lockdown measures eased, resulting in stronger demand. This assisted commodity-based currencies such as the Australian Dollar which surged over 3.5%.

• Gold gained nearly 3% as a result of plentiful stimulus, low yields and a declining US Dollar, the precious metal is up over 17% year to date.

• Emerging Market Currencies such as the Mexican Peso and Brazilian Real declined as both countries continue to struggle with the ongoing pandemic.

Harry Elliman

Choose a Service to Invest through

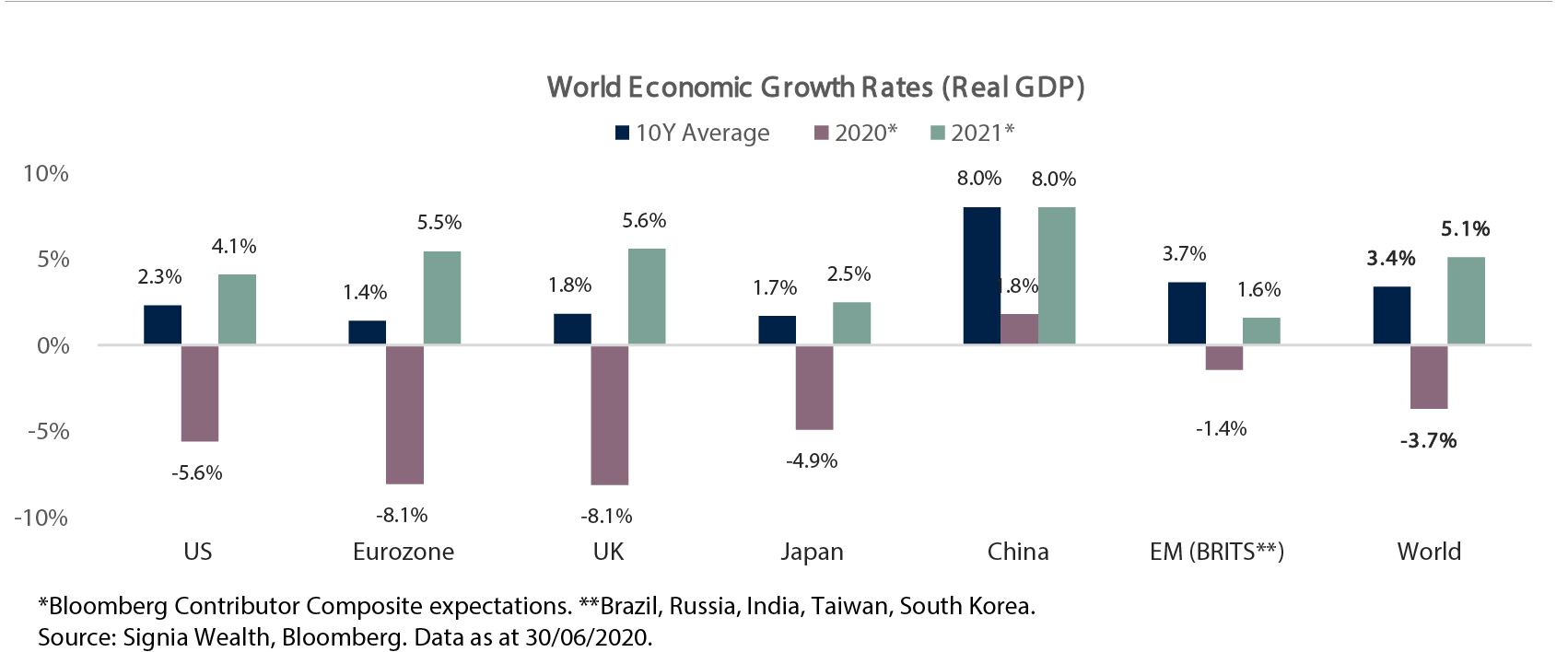

World

Expectations for World growth in 2020 have been revised down considerably in the wake of the Coronavirus crisis, from+3.1% at the end of 2019 to -3.0% in May and now -3.7% in June. Asian economies are expected to outperform with China, India and Indonesia the only G20 economies expected to increase their levels of economic output this year. Currently, world growth is expected to rebound strongly next year, although this remains largely contingent on the rollout of a successful Covid-19 vaccine and the absence of subsequent and sizeable waves of global infections.

United States of America

The economy is rebounding quicker than expected in Q2 after the shortest sharpest economic contraction in history. Most states relaxed their lockdown rules and reopened for business in May, but with signs of rising infections across southern states in June the economic recovery will likely slow in H2 as some lockdown restrictions are reintroduced.

Eurozone

Europe entered 2020 on a relatively weak economic footing so it’s no surprise that it will likely experience a deeper recession this year versus other regional economies. Deflation risk is now a real concern but with the European Commission announcing plans for a €750bn European Recovery Fund growth expectations for 2021 and beyond are rising.

United Kingdom

The UK has followed a similar economic fate to Europe after being slow to introduce coronavirus containment measures resulting in the UK suffering the most Covid-10 deaths in Europe and the third most worldwide behind the US and Brazil.

Japan

The Japanese economy is geared towards global trade activity and has suffered disproportionally more than its regional neighbours this year as global trade seized up, however it’s expected to stage a resilient domestic recovery following significant fiscal and monetary stimulus packages announced by policymakers to battle the virus and spur growth.

China

China has seemingly managed to contain any second wave of the virus and navigate its economy along a V-shaped recovery, with economic operating capacity now back near 2019 levels. After contracting heavily in Q1, a technical recession of two consecutive negative quarters of GDP is now unlikely as Q2 growth is expected to be positive. External trade is reliant on a pick-up in global demand that is lagging behind China, and so some risks remain to this outlook.

Emerging Markets

Emerging economies outside of Asia have been amongst the last to feel the full economic and humanitarian hit from the coronavirus crisis. Economic performance is expected to be mixed across the BRITS block this year: Brazil and Russia as commodity producers suffering from a collapse in prices; India as a net importer of commodities benefitting from price declines; and Taiwan and South Korea feeling less economic pain domestically due to successful virus testing and containment measures.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.