From Fear to FOMO: stimulus to the rescue

The Chinese word for “crisis” is popularly invoked in the Western world as being composed of two Chinese hanzi characters signifying “danger” and “opportunity”. Needless to say the parallels with the 2020 coronavirus crisis are stark and eloquent. It captures a crisis that started in China, a pandemic that is a clear and present danger to humanity, and a March Meltdown in markets that offered an unexpected opportunity to investors worldwide.

The opportunity in equity markets was seized upon in April, after policymakers across the globe responded in unison with stimulus packages and support programmes that were unprecedented in speed, size and scope. The result saw investors’ fear, that had engulfed markets in the March selloff, quickly turn to fear of missing out, as the S&P 500 index rose +12.7% in April to post its best monthly return since January 1987.

The coronavirus pandemic has caused the fastest and deepest global economic shock in history via a series of cascading economic sudden stops across the world. The US economy has now lost more jobs in the last two months that it gained during ten years of rebuilding after the Global Financial Crisis. Quite astonishing. On the surface the April jobs report made grim reading, showing the US unemployment rate surging to a record 14.7% and payrolls dropping by an historic 20.5 million workers. However, there was a silver lining in all of this and a significant one at that: roughly 4/5th of these workers registered as temporary layoffs and not as the permanent redundancies that are otherwise associated with long lasting economic recessions.

Thanks to a myriad of stimulus support programmes aimed at bridging temporary household income gaps and business revenue shortfalls, it seems that economic insolvencies have largely been prevented, for now at least.

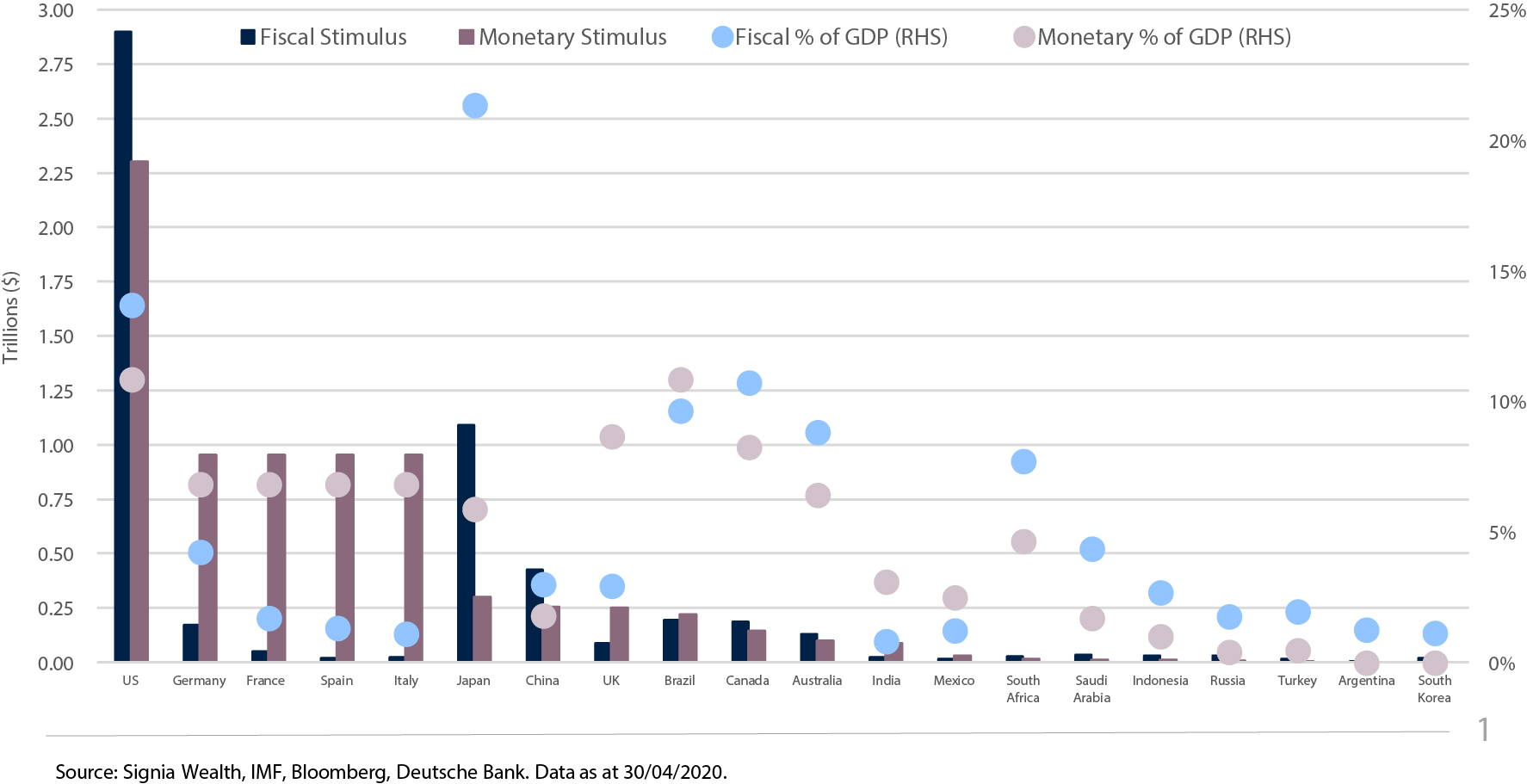

It’s not just the US, the global response has also been surprisingly swift and powerful, with G20 stimulus programmes surpassing $10 trillion –$5.5tn on the fiscal side and $4.7 on the monetary side to date, and rising. Admittedly, about half of this has come from the US, and rightly so, as the world’s largest economy and steward of the world’s reserve currency. Relative to the size of their economies it has been Japan that has led the way on the fiscal side (21% of GDP), and Brazil alongside the US on the monetary quantitative easing side (both 11% of GDP). Notably, a growing proportion of emerging market central banks are now throwing their hats onto the QE ring, which begs the question: can this have the same affect on EM financial valuations this decade than it has had on DM valuations over the last decade?

The G20 Stimulus Response to COVID-19

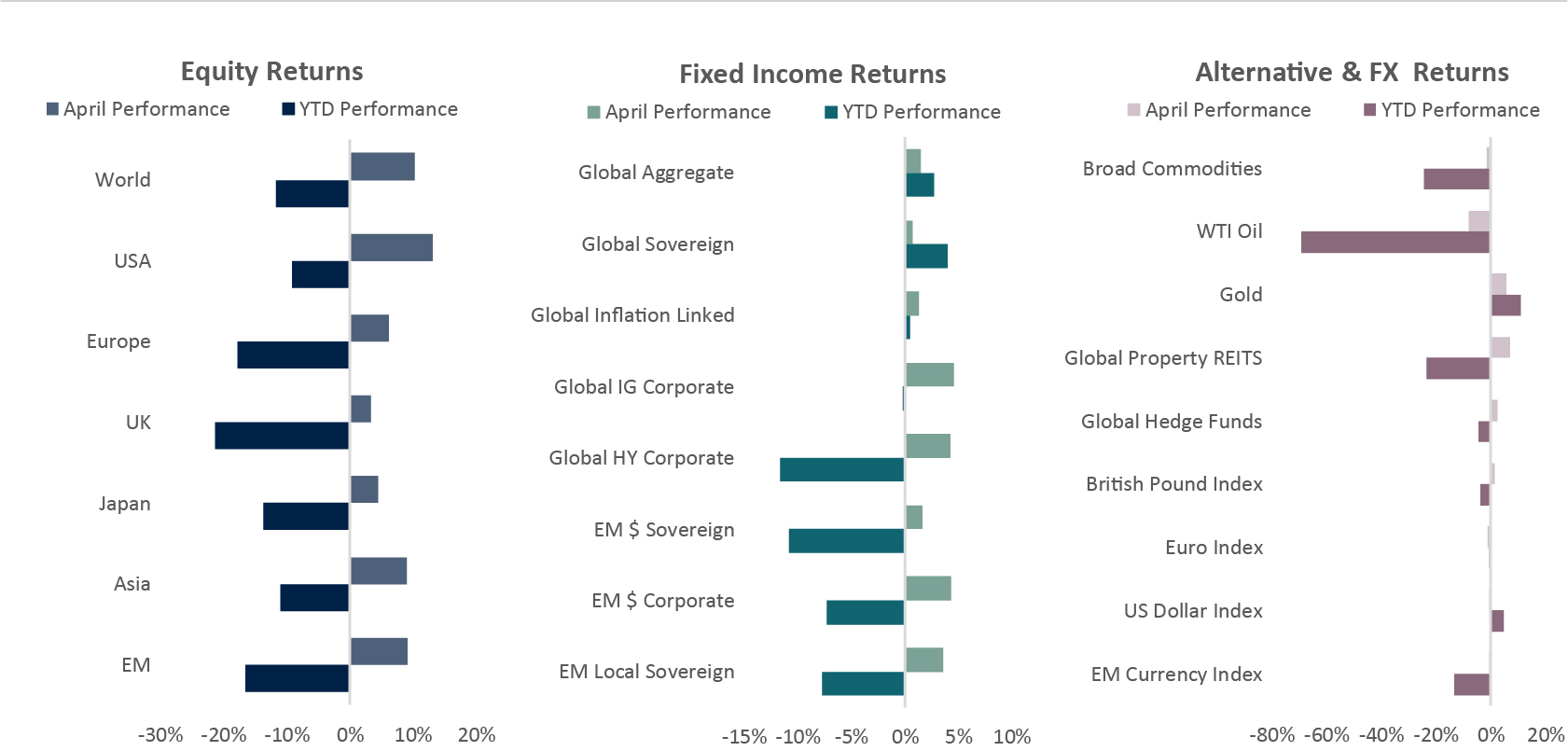

Source: Bloomberg, Signia Wealth. Data as at 30/04/2020. Equities: Equity indices reflect MSCI net total returns in local currency, except Asia and EM in USD. Fixed Income: Global Agg: Bloomberg Global Aggregate TR Hedged GBP; Global Sovereign: Bloomberg Global Treasury TR Hedged GBP; Global IL: Bloomberg World Govt Inflation Linked Bonds 1-10Y TR Hedged GBP; Global IG: Bloomberg Global Corporate TR Hedged GBP; Global HY: Bloomberg Global High Yield TR Hedged GBP; EM$ Sov: Bloomberg Emerging Markets Sovereigns TR Hedged GBP; EM$ Corp: Bloomberg EM USD Corporate 10% Cap Hedged GBP; EM Local Sov: Bloomberg EM Local Currency Govt TR Unhedged USD; Commodities: Bloomberg Commodity TR Index; Global Property REITS: FTSE EPRA/NAREIT Global Index; Global Hedge Fund: HFRX Global Hedge Fund Index; British Pound: Bloomberg British Pound Index; Euro: Bloomberg Euro Index; US Dollar: Bloomberg US Dollar Index; EM Currency: JP Morgan Emerging Market Currency Index.

Equities

• US equity markets rebounded sharply in April, as unprecedented fiscal and monetary stimulus helped to offset coronavirus concerns.

• Asian and emerging market bourses fared next best, with stimulus and falling rates of virus infection fuelling risk appetite.

• UK, European, and Japanese equities achieved positive returns but lagged other markets, principally due to their lower weights in technology companies.

Jack Rawcliffe

Fixed Income

• The global sovereign debt index was up 0.8% as investors continued to assess the impact of the COVID19 lockdowns and digest the negative economic data releases throughout the month.

• In corporate credit, global investment grade and global high yield debt indices were up 4.6% and 4.3%respectively on the back of extraordinary monetary and fiscal policy support from central banks and governments.

• Emerging market debt indices also benefitted as improved risk sentiment saw a rebound in all EM indices with the EM Corporate index outperforming the EM local currency and EM hard currency sovereign indices.

Grégoire Sharma

Alternatives & FX

• WTI continued its volatile trend in April by declining 8% as the collapse in demand for oil outweighed any supply reduction discussed by OPEC+. The WTI active May contract collapsed into negative territory for the first time, reaching a price of -$37.63 as investors paid to avoid delivery amidst a shortage in storage capacity.

• As a result of Bolsonaro’s poor handling of the COVID-19 outbreak the Brazilian Real declined over 5%. The Brazilian Real is now down nearly 27% in 2020.

Harry Elliman

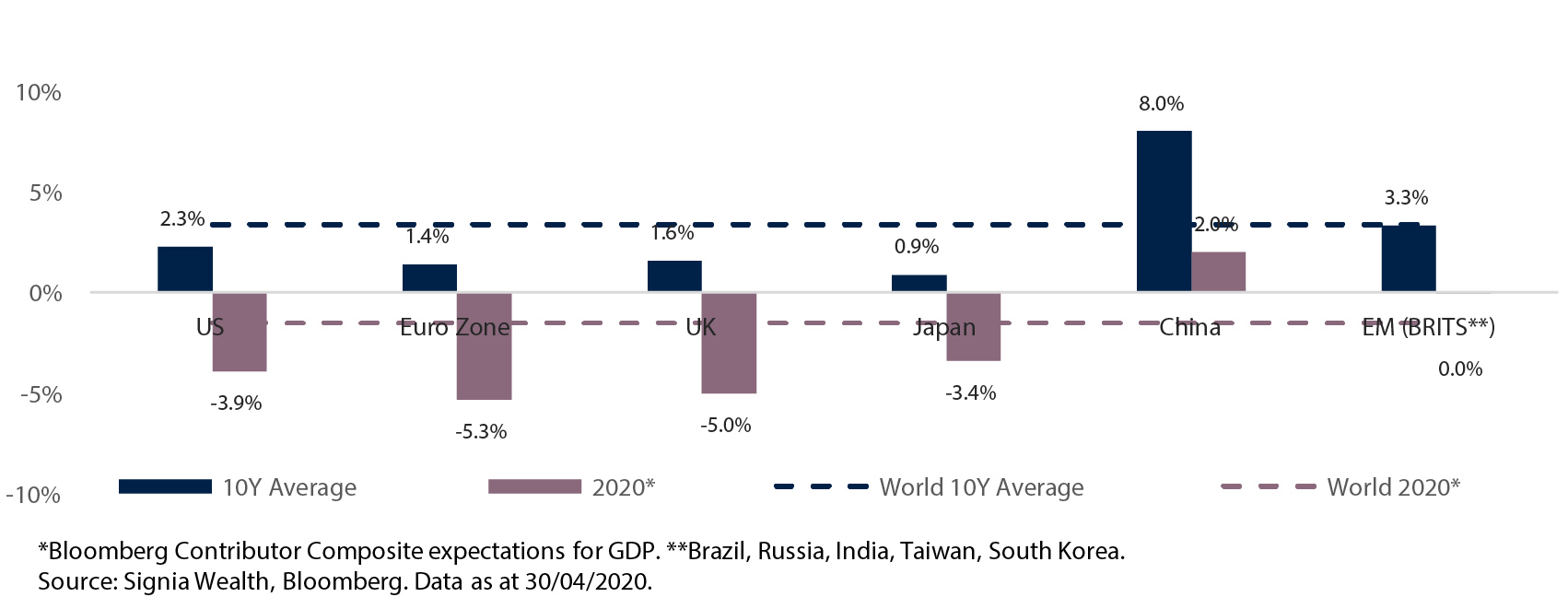

Regional Economic Growth: Last 10 Years versus Expectations for 2020

Choose a Service to Invest through

World

Expectations for World growth this year have been revised down considerably in the wake of the Coronavirus crisis, from+3.1% at the start of the year to now -1.5% in 2020. Asian economies are expected to outperform, with China, India, South Korea and Indonesia the only G20 major economies that are expected to increase their levels of economic output this year.

United States of America

A sharp but potentially short recession is underway as Q1 GDP contracted more than expected after just 2 weeks of the economy in lockdown in March. Most states are planning to relax lockdown rules and reopen for business in May, but with a full month of lockdown in April now baked in to Q2 GDP, an even deeper contraction this quarter is expected. Medical progress has been quicker than expected with treatments already becoming available that could mitigate the effects of a second wave of infections.

Eurozone

Europe entered 2020 on a relatively weak economic footing so it’s no surprise that it will likely experience a deeper recession this year versus other regional blocks. Long-term unemployment is expected to rise by 4% and deflation risk will become a serious concern this year.

United Kingdom

The UK has followed a similar economic fate to Europe after being slow to introduce coronavirus containment measures, which resulted in prime minister Boris Johnson being admitted to intensive care in hospital with COVID-19, and the country subsequently suffering the most deaths in Europe. Unemployment is also expected to spike, but more so on the temporary side and is not expected to be as bad as the 1930s depression.

Japan

Economic growth was still recovering from a fourth quarter 2019 consumption tax hike before the coronavirus hit the economy. The Japanese economy has suffered as global trade temporarily seizes up, but it is expected to recover faster this year alongside its regional neighbours and also benefit from significant domestic fiscal and monetary stimulus packages.

China

China has seemingly managed to contain any second wave of the virus and navigate its economy along a V-shaped recovery, with economic operating capacity already back above 90%. After suffering heavily in Q1, an economic recession is now unlikely for the Chinese economy as Q2 growth is expected to be positive. External trade is reliant on a pick-up in global demand that is lagging behind China, and so some risks remain to this outlook.

Emerging Markets

Emerging economies outside of Asia have been amongst the last to feel the full economic and humanitarian hit from the coronavirus crisis. That said, economic performance is expected to be mixed across the BRITS block this year: Brazil and Russia as producers suffering from a collapse in commodity prices; India as a net importer of commodities benefitting from this; and Taiwan and South Korea returning to normality after seemingly eradicating the virus from their countries.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.