The exit strategy what else to look for

As the population gradually learns to accept and live in a COVID-19 world, the key question for investors is whether economies will recover swiftly or stay depressed for a considerable period of time; (the “V” shaped recovery versus a “U” shaped recovery). As a result scientists are now looking at various non economic metrics to forecast the state of economic recovery.

Sophisticated investors have long sought an edge through the harvesting of new data sources. Advances in technology have allowed access to unique datasets which would have been difficult to obtain historically, (such as aggregated customer receipt information, or retail store car park usage obtained via drones). The rise of big data combined with cheaper processing power has dramatically simplified the process of obtaining and aggregating data.

Anyone who switches on location services on their smartphone can see just how much information the operating system providers have access to, and as the UK rolls out it’s contact tracing app, this has become more than a service of convenience, but is now a matter of population wellbeing.

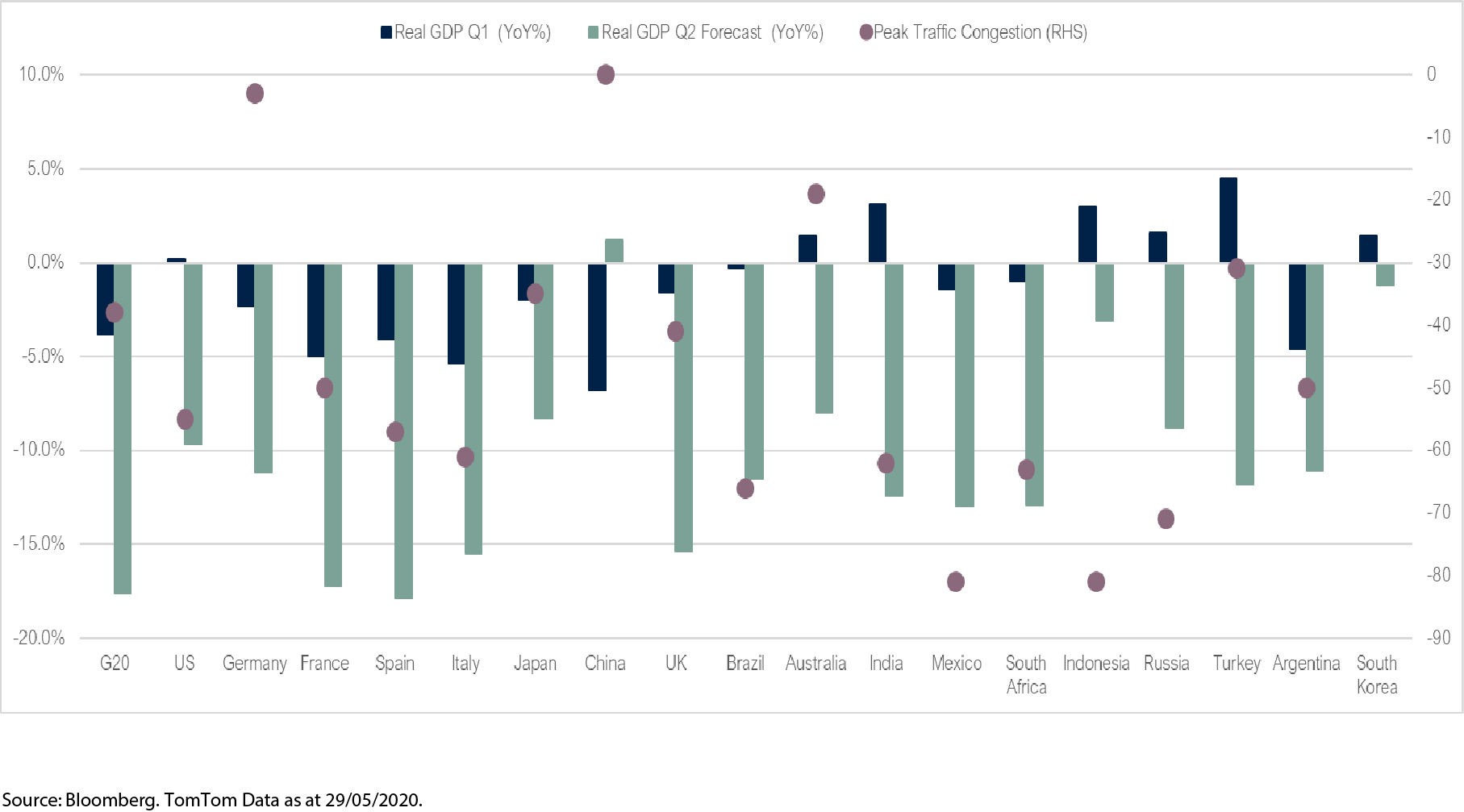

As well as the now often quoted Google mobility metrics, TomTom produce a traffic index which shows congestion levels across various countries and cities presently compared to one year ago. It can be used as another data point to track the speed at which economies are coming out of lockdown and to assess current levels of activity. Unsurprisingly, whilst most major economies are still significantly below last year’s congestion metrics, China and Germany are close to equal to last year’s levels. Subject to a possible second wave of infections leading to a reintroduction of lockdowns, it should not take long for traffic congestion to revert back to prior levels in other major economies.

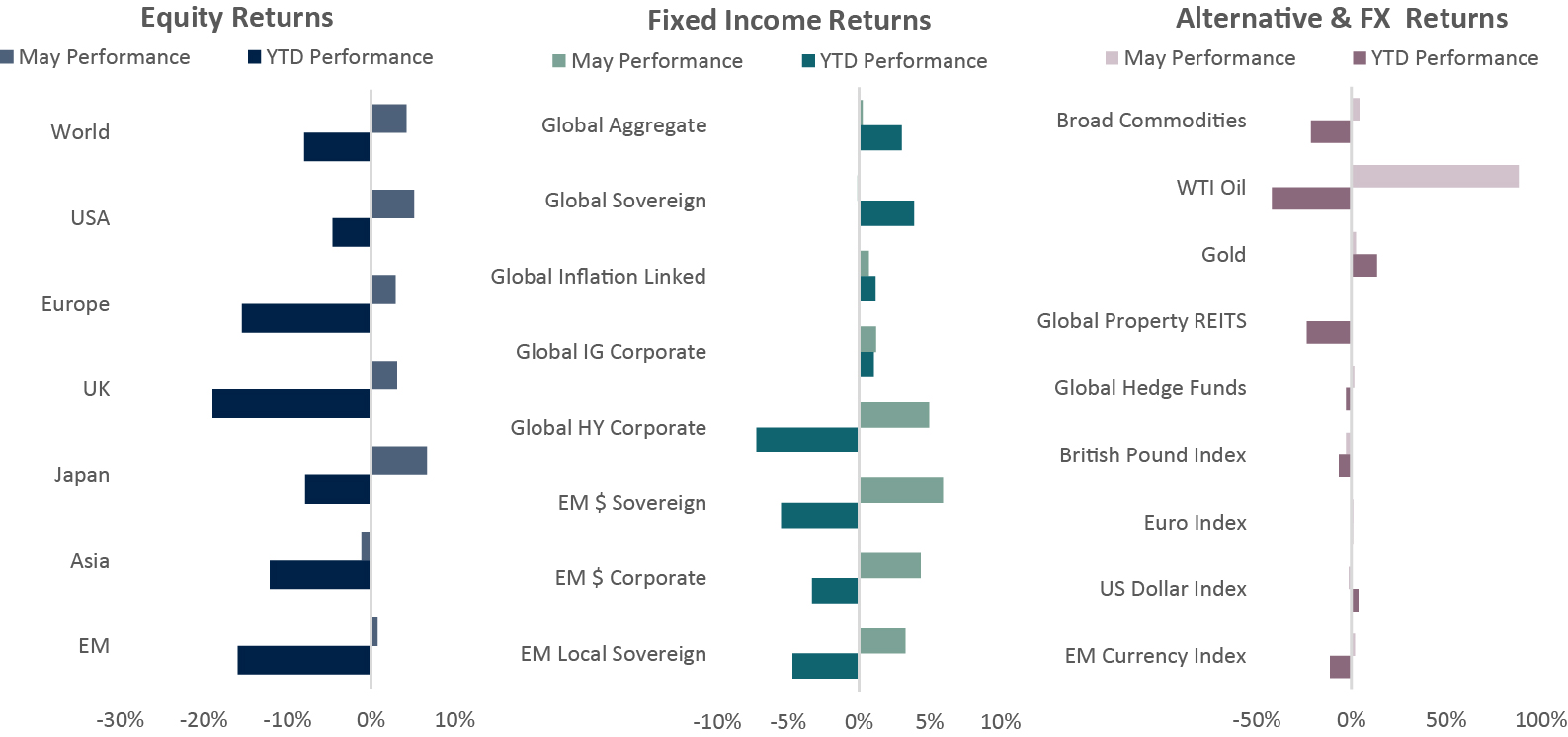

Source: Bloomberg, Signia Wealth. Data as at 29/05/2020. Equities: Equity indices reflect MSCI net total returns in local currency, except Asia and EM in USD. Fixed Income: Global Agg: Bloomberg Global Aggregate TR Hedged GBP; Global Sovereign: Bloomberg Global Treasury TR Hedged GBP; Global IL: Bloomberg World Govt Inflation Linked Bonds 1-10Y TR Hedged GBP; Global IG: Bloomberg Global Corporate TR Hedged GBP; Global HY: Bloomberg Global High Yield TR Hedged GBP; EM$ Sov: Bloomberg Emerging Markets Sovereigns TR Hedged GBP; EM$ Corp: Bloomberg EM USD Corporate 10% Cap Hedged GBP; EM Local Sov: Bloomberg EM Local Currency Govt TR Unhedged USD; Commodities: Bloomberg Commodity TR Index; Global Property REITS: FTSE EPRA/NAREIT Global Index; Global Hedge Fund: HFRX Global Hedge Fund Index; British Pound: Bloomberg British Pound Index; Euro: Bloomberg Euro Index; US Dollar: Bloomberg US Dollar Index; EM Currency: JP Morgan Emerging Market Currency Index.

Equities

• Japanese equities achieved the strongest returns in May, as post-virus recovery hopes helped spur investor appetite for risk

• US equity markets were next best, with increased risk appetite and central bank stimulus underpinning gains

• European and UK equity indices posted very similar positive returns

• EM equities lagged, whilst the Asian index recorded a negative return in USD terms as Chinese and Indian markets underperformed

Jack Rawcliffe

Fixed Income

• The Global Treasuries index was down -0.08% on the month as the continued slow-down in the global growth rate of COVID-19 cases and the ease of lockdown measures in developed market nations led to a rally in risk assets.

• Global Corporate Credit rallied significantly on the back of the risk-on sentiment and the continued support from monetary and fiscal stimulus globally. The Global Investment Grade Credit index was up 1.19%whereas the Global High Yield Corporate Credit index was up 4.90%.

• Emerging Market Debt Indices were amongst the best performing fixed income indices this month, benefitting from the pickup in sentiment in developed markets.

Grégoire Sharma

Alternatives & FX

• Oil rebounded significantly in May surging nearly 90% as concerns eased on both the supply and demand side. This was also aided by Russia & OPEC’s production cut discussions.

• Gold continued its outstanding performance gaining over 2.5%, the precious metal is now up over 14%for 2020.

• Wall Street’s “Fear Gauge”, the VIX, declined nearly 20% below 28, as investors concerns surrounding COVID-19 eased and they looked towards the reopening of the global economy.

Harry Elliman

Choose a Service to Invest through

World

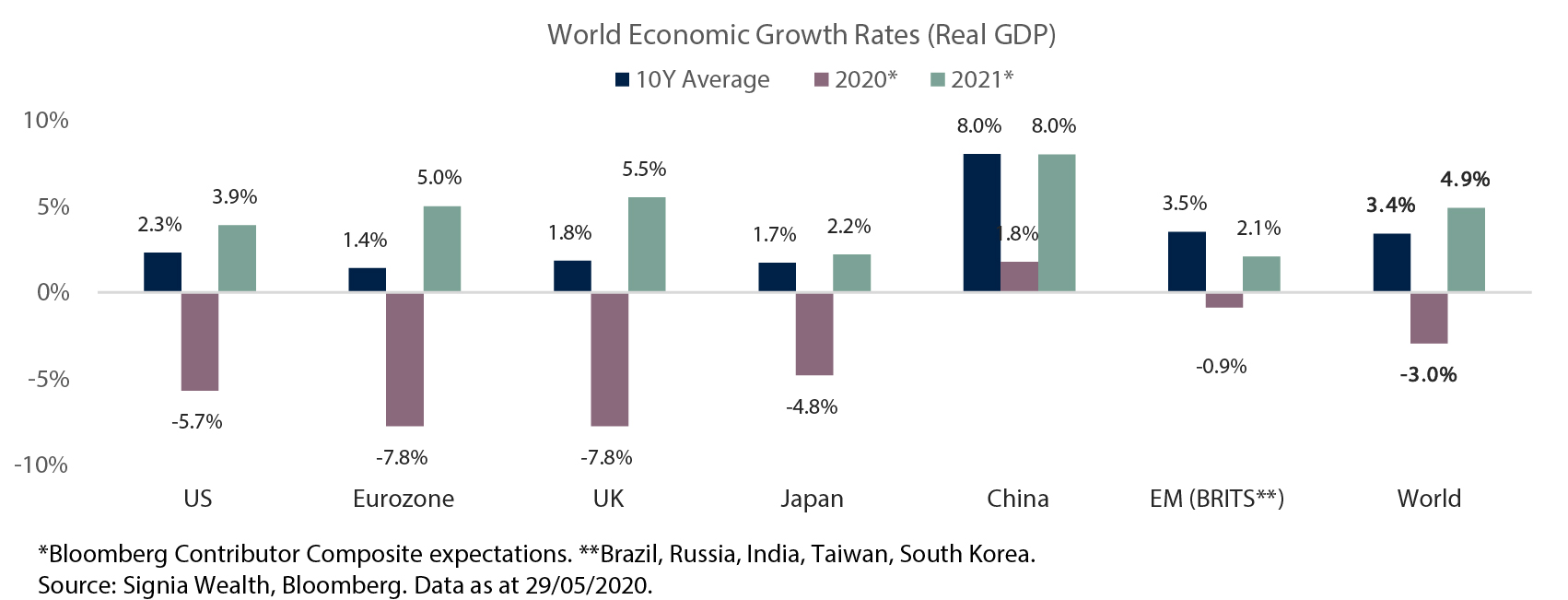

Expectations for World growth in 2020 have been revised down considerably in the wake of the Coronavirus crisis, from+3.1% at the end of 2019 to -3.0% in May. Asian economies are expected to outperform with China, India and Indonesia the only G20 economies expected to increase their levels of economic output this year. Medical progress has been quicker than expected with treatments already becoming available that could mitigate the effects of a second wave of infections.

United States of America

A sharp but likely short recession is underway as Q1 GDP contracted more than expected after just 2 weeks of the economy in lockdown in March. Most states relaxed their lockdown rules and reopened for business in May, but with full lockdown measures in place during April an even deeper economic contraction in Q2 is expected.

Eurozone

Europe entered 2020 on a relatively weak economic footing so it’s no surprise that it will likely experience a deeper recession this year versus other regional economies. Deflation risk is now a real concern but with the European Commission announcing plans for a €750bn European Recovery Fund growth expectations for 2021 and beyond are rising.

United Kingdom

The UK has followed a similar economic fate to Europe after being slow to introduce coronavirus containment measures resulting in the UK suffering the most deaths in Europe, and the second most worldwide behind the US.

Japan

The Japanese economy is geared towards global activity and has suffered disproportionally more than its regional neighbours this year as global trade temporarily seizes up, however it is expected to recover faster following significant fiscal and monetary stimulus packages announced by policy makers to battle the virus and spur growth

China

China has seemingly managed to contain any second wave of the virus and navigate its economy along a V-shaped recovery, with economic operating capacity now back near 2019 levels. After contracting heavily in Q1, an economic recession is now unlikely as Q2 growth is expected to be positive. External trade is reliant on a pick-up in global demand that is lagging behind China, and so some risks remain to this outlook.

Emerging Markets

Emerging economies outside of Asia have been amongst the last to feel the full economic and humanitarian hit from the coronavirus crisis. Economic performance is expected to be mixed across the BRITS block this year: Brazil and Russia as commodity producers suffering from a collapse in prices; India as a net importer of commodities benefitting from price declines; and Taiwan and South Korea feeling less economic pain domestically due to successful virus testing and containment measures.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.