March Meltdown: the fastest bear market in history

Denial, panic, hope – usually these three phases of investor emotions take years to play out, manifesting themselves into a market cycle.

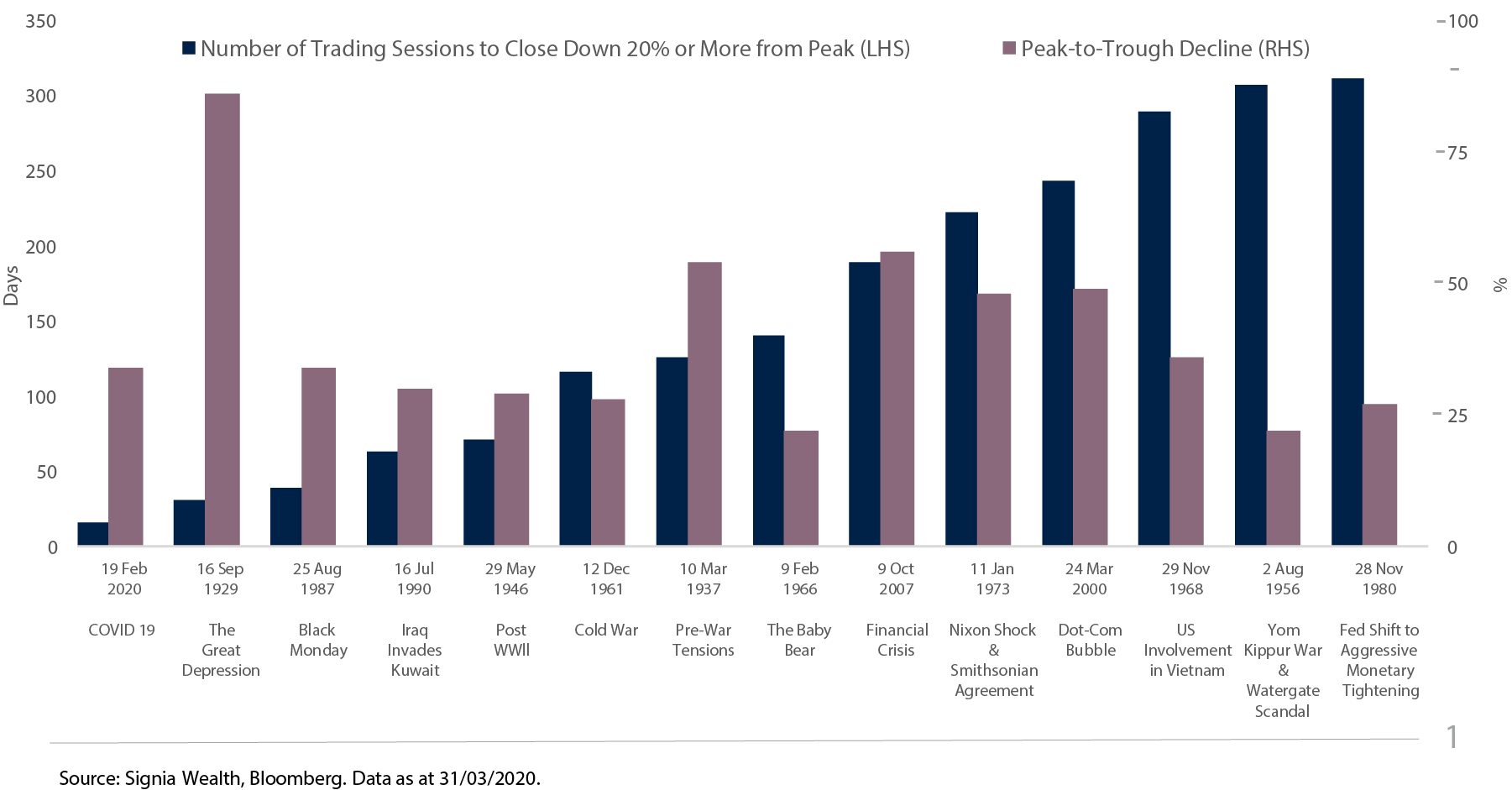

There’s no doubt that we are still transitioning into a period of tentative hope, as the coronavirus roller-coaster that started in February and intensified beyond anyone’s expectations in March, is still reverberating strongly across global markets and in investors’ minds. In fact, the sell-off was so sharp and severe that it only took a mere 16 trading days for the US S&P 500 equity index to register its fastest ever bear market in history on 12th March, by declining by 20% or more from its 19th February peak. To put this into perspective, this bear market crash was quicker than both the 1929 Great Depression and 1987 Black Monday sell-offs, which took 31 and 39 trading days respectively to register their 20%declines.

This March meltdown followed another record, the longest ever bull market in US history – the opposite to a bear market – which saw the S&P 500 index rise 400% over 11 years from the nadir of the March 2009 Global Financial Crisis. Arguably, markets were overstretched and businesses were overleveraged, drunk on a monetary punchbowl of quantitative easing and cheap borrowing costs.

However, running alongside this decade of stellar financial market performance was the more sobering and contrasting theme of austerity, ushered in to discourage excess borrowing and superfluous spending habits. Alas, today we find ourselves in a bizarre new era of responsibility, one where governments worldwide are in a socially acceptable race to see who can spend more on their economies and populations to combat the unfolding Covid-19 humanitarian crisis.

Indeed, if this was a spending contest then the US is leading the way, pledging trillions of dollars in truly unprecedented amounts to backstop financial markets and provide one of the most generous fiscal packages to its citizens. The fact that this is an election year has most certainly helped spur Congress into plugging the income gaps for households during this first historical self-induced economic recession. Nevertheless, G20 nations have also displayed their ‘whatever it takes’ intent, and despite horrendous forecasts for business losses and economic declines this summer, markets have initially reacted positively.

Seemingly markets don’t care about this quarter, or even next quarter, they care about the next couple of years. However, this is clearly not a normal bear market and we are clearly not in a normal recession. It will most likely be more of a marathon and not a sprint, and only the test of time will reveal policymakers’ resolve.

S&P 500 Bear Markets

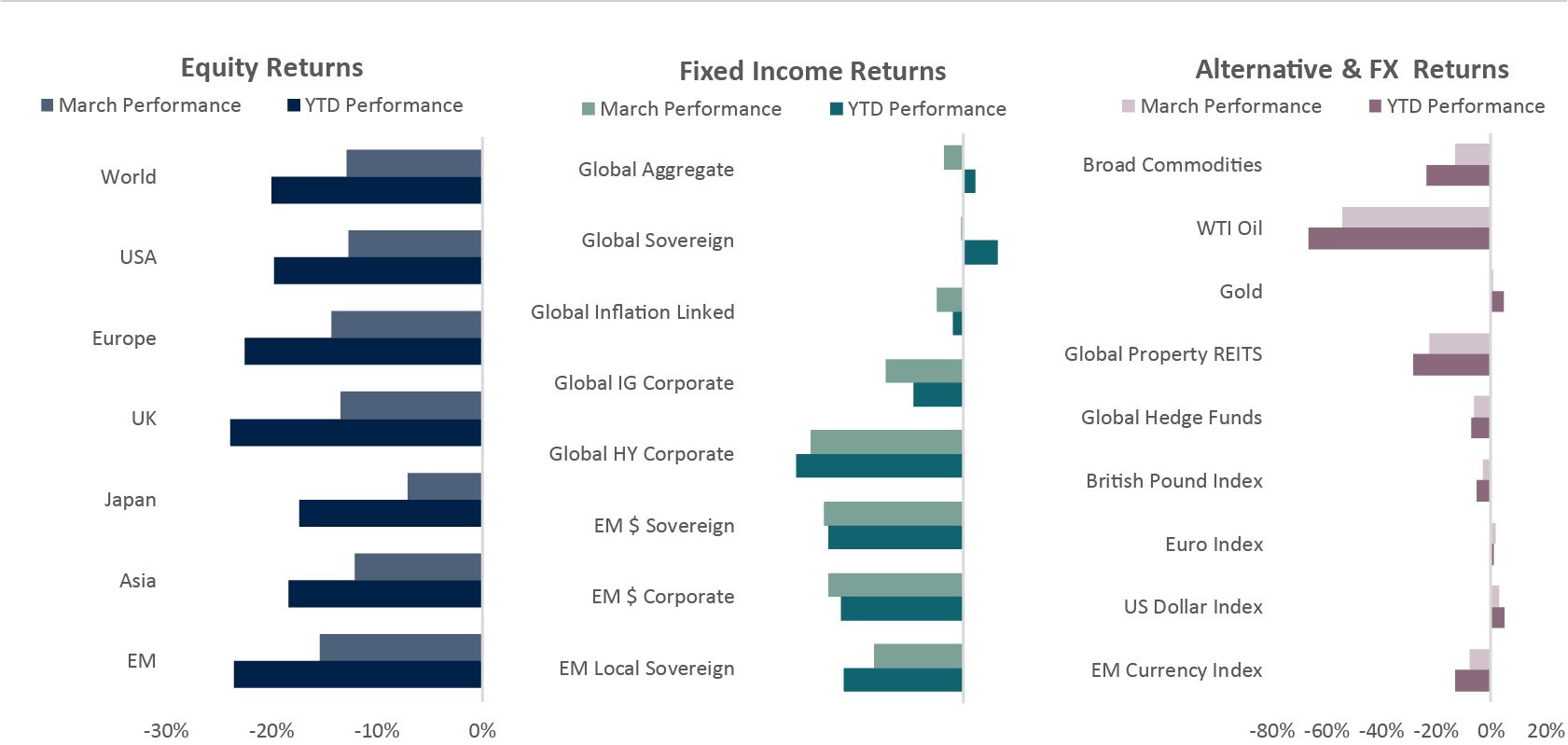

Source: Bloomberg, Signia Wealth. Data as at 31/03/2020. Equities: Equity indices reflect MSCI net total returns in local currency, except Asia and EM in USD. Fixed Income: Global Agg: Bloomberg Global Aggregate TR Hedged GBP; Global Sovereign: Bloomberg Global Treasury TR Hedged GBP; Global IL: Bloomberg World Govt Inflation Linked Bonds 1-10Y TR Hedged GBP; Global IG: Bloomberg Global Corporate TR Hedged GBP; Global HY: Bloomberg Global High Yield TR Hedged GBP; EM$ Sov: Bloomberg Emerging Markets Sovereigns TR Hedged GBP; EM$ Corp: Bloomberg EM USD Corporate 10% Cap Hedged GBP; EM Local Sov: Bloomberg EM Local Currency Govt TR Unhedged USD; Commodities: Bloomberg Commodity TR Index; Global Property REITS: FTSE EPRA/NAREIT Global Index; Global Hedge Fund: HFRX Global Hedge Fund Index; British Pound: Bloomberg British Pound Index; Euro: Bloomberg Euro Index; US Dollar: Bloomberg US Dollar Index; EM Currency: JP Morgan Emerging Market Currency Index.

Equities

• All equity markets were sharply down in March due to the continuing economic disruption from coronavirus, with emerging market indices the worst performer.

• Japanese equities relatively outperformed, however, with a sharp mid-month rally helping to reduce losses.

• UK, European, US, and Asian bourses all fell by more than 10%, as progressively restrictive lockdowns were imposed to curb the spread of coronavirus.

Jack Rawcliffe

Fixed Income

• The global sovereign debt index was broadly flat in dollar hedged terms despite a very volatile month as markets attempted to digest the impact of the Covid-19 imposed lockdowns across the globe.

• In corporate credit, global investment grade and global high yield indices finished the month in negative territory, -7% and -14% respectively, suffering from a liquidity squeeze and forced selling by investors.

• Emerging market debt indices also ended March down as local currency debt dropped 8% on high EM FX volatility and hard currency debt suffered due to a dollar liquidity squeeze which was subsequently addressed by the FED intervention towards the end of the month.

Grégoire Sharma

Alternatives & FX

• WTI had its worst ever month and quarter in 2020, falling 54% and 66% respectively. On-going tensions between Saudi Arabia and Russia on the supply-side amplified restrictions implemented by world governments in response to the on-going pandemic on the demand-side.

• Wall Street’s fear gauge, the VIX, rose over 33% in March to hit an all-time high, surpassing its record established during the financial crisis. The gauge surged nearly 290% in the year’s first quarter.

• Both commodity and emerging market currencies suffered in March due to the current pandemic, as investors sought safe haven currencies and USD liquidity.

Harry Elliman

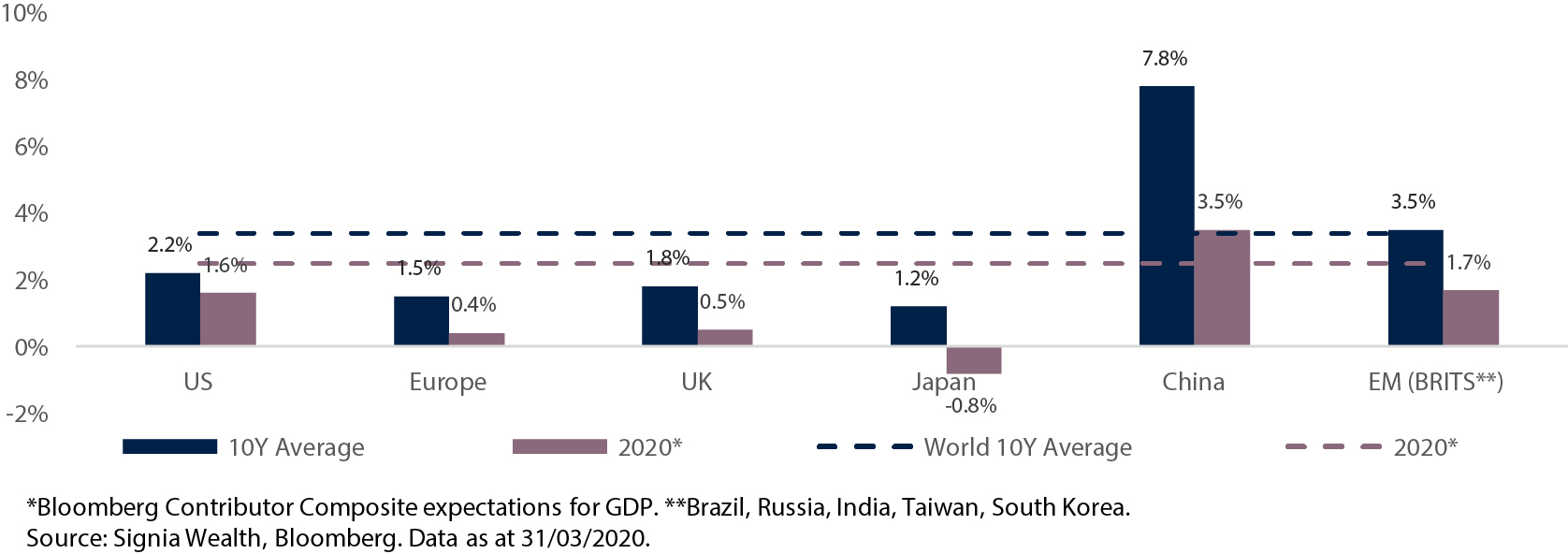

Regional Economic Growth: Last 10 Years versus Expectations for 2020

Choose a Service to Invest through

World

World growth is expected to continue slowing considerably this year, from 3.6% in 2018 and 2.9% in 2019, to 2.5% in 2020, albeit much of the negative coronavirus impact is still to feed through to the underlying economic data so further downward revisions are expected. Despite upward momentum from China, a short and sharp global economic recession – defined as two consecutive quarters of negative GDP growth – cannot be ruled out this year.

United States of America

The US has seen labour market indicators start to deteriorate sharply recently with consensus forecasts for unemployment to rise significantly in 2020, back to towards peak 2009 financial crisis levels around 10%. A short and significant economic contraction this year is expected.

Europe

Europe entered 2020 on a relatively weak economic footing versus other regional blocks, and with Italy, Spain and France suffering badly in March from the coronavirus crisis, Europe is arguably already in a deep economic recession.

United Kingdom

The UK has followed a similar economic fate to Europe after being slow to introduce coronavirus containment measures, which has even resulted in prime minister Boris Johnson testing positive for covid-19.

Japan

Economic growth was still recovering from a fourth quarter 2019 consumption tax hike before the coronavirus hit the economy. As global trade temporarily seizes up, the Japanese economy, which is geared towards world trade activity, is expected to suffer disproportionally more than others.

China

China is ahead of the covid-19 epidemic curve and has seemingly contained the spread of the virus, with its economy back to operating at 90% capacity. After suffering heavily in Q1, an economic recession is now less likely for the Chinese economy.

Emerging Markets

With most of the EM economies still to feel the full impact of the coronavirus, and with a strong US Dollar headwind this year, it is very likely that growth expectations for the BRITS block in 2020 are substantially revised down. India in particular is at risk of a very serious epidemic and economic meltdown.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.