Not All Viruses Are Born The Same

In our last Talking Points, Going Viral, we looked at the history of influenza pandemics, defined as a flu virus that spreads on a worldwide scale infecting a large proportion of the population, and concluded that there have been on average three in each century over the last 300 years. Whilst seemingly infrequent, it’s worth noting that in an increasingly interconnected world it has only taken nine years in this century for the 2009 H1N1 ‘swine flu’ virus to be declared a pandemic, and now only 11 years later the World Health Organisation has declared Covid-19 as the second.

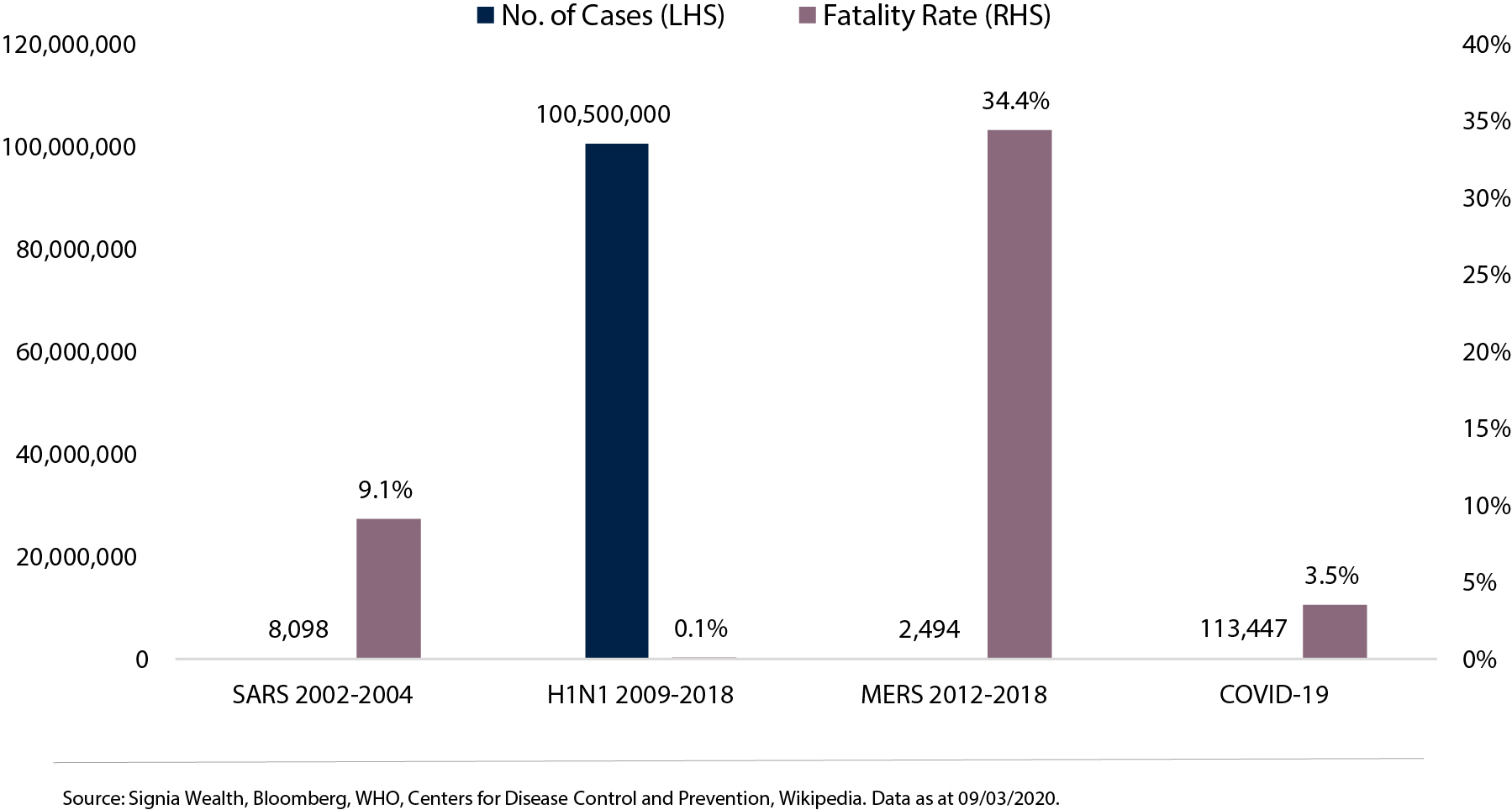

In fact, Covid-19 is the fourth major epidemic of this century after H1N1, SARS and MERS, that has threatened to spread into a global pandemic. Unlike SARS in 2002 and MERS in 2012 that were successfully contained, Covid-19 has proven too pervasive and difficult.

The good news is Covid-19 is less dangerous, with a reported fatality rate of 3-4% (albeit in reality including unreported cases this is likely lower), versus 9% for SARS and 34% for MERS. Fortunately, both of these deadlier viruses were less infectious and only infected 8,098 and 2,494 people, respectively. Both viruses were stopped in their tracks by a combination of draconian top-down measures that halted human-to-human transmission, and for SARS this was enough to eradicate the disease completely.

Since Covid-19 was discovered recently in December 2019, there have been 113,447 reported cases, as of 9th March. The spread of the coronavirus continues mostly unabated outside of China and South Korea, where growth in new cases is rising between 15-25% per day. This unexpected rate of worldwide contagion is proving to be a major concern for markets, society and policymakers alike. The threat of world economic activity grinding to a halt may be overblown, but it has caught policymakers off-guard, whose job is now to both isolate their populations whilst preventing any temporary economic shocks from mutating into permanent business insolvencies and employee redundancies. No easy task! However, despite all the uncertainty Covid-19 has brought us in 2020 one thing is certain; after years of central bank stimulus in the face of fiscal austerity the once elusive marriage between monetary and fiscal policies are finally uniting. Governments worldwide, especially in Europe, are finally showing intent by loosening their purse strings to contain the economic fallout, if indeed not the virus.

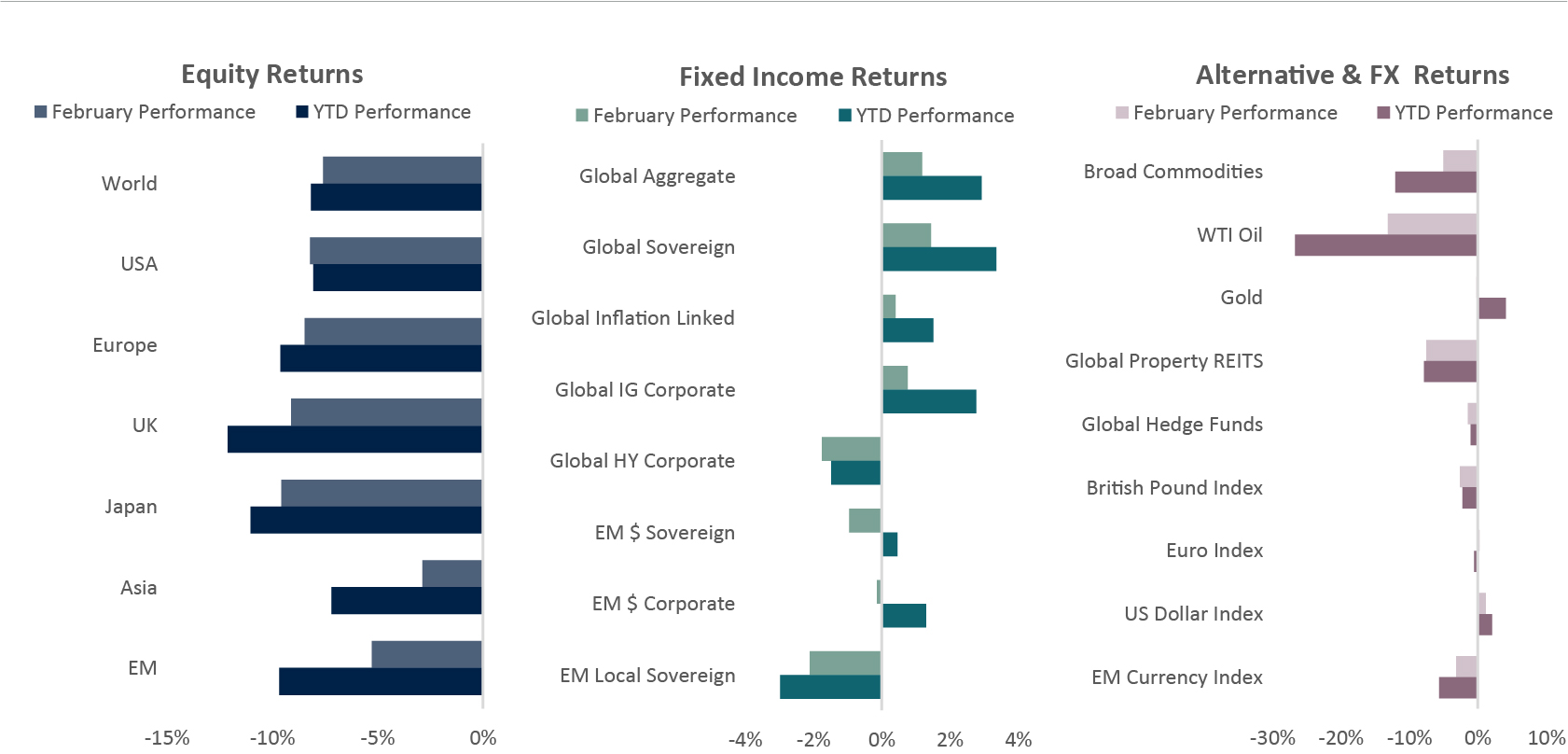

Source: Bloomberg, Signia Wealth. Data as at 29/02/2020. Equities: Equity indices reflect MSCI net total returns in local currency, except Asia and EM in USD. Fixed Income: Global Agg: Bloomberg Global Aggregate TR Hedged GBP; Global Sovereign: Bloomberg Global Treasury TR Hedged GBP; Global IL: Bloomberg World Govt Inflation Linked Bonds 1-10Y TR Hedged GBP; Global IG: Bloomberg Global Corporate TR Hedged GBP; Global HY: Bloomberg Global High Yield TR Hedged GBP; EM$ Sov: Bloomberg Emerging Markets Sovereigns TR Hedged GBP; EM$ Corp: Bloomberg EM USD Corporate 10% Cap Hedged GBP; EM Local Sov: Bloomberg EM Local Currency Govt TR Unhedged USD; Commodities: Bloomberg Commodity TR Index; Global Property REITS: FTSE EPRA/NAREIT Global Index; Global Hedge Fund: HFRX Global Hedge Fund Index; British Pound: Bloomberg British Pound Index; Euro: Bloomberg Euro Index; US Dollar: Bloomberg US Dollar Index; EM Currency: JP Morgan Emerging Market Currency Index.

Equities

• All equity markets were sharply down in February due to the economic impact of coronavirus, with the more cyclical Japanese index the heaviest faller.

• UK, European, and US bourses fared marginally better but still fell more than 8% each, again due to the coronavirus and its subsequent impact on global growth.

• Emerging markets and Asian equity indices relatively outperformed, with cheaper valuations going into the month helping to limit losses.

Jack Rawcliffe

Fixed Income

• February was a risk-off month due to investor worries surrounding the impact the coronavirus will have on the global economy. As a result safe haven assets were the best performing fixed income asset class with the US 10y treasury yields falling to record lows below 1.2%.

• Global credit markets were mixed with higher quality investment grade credit generating positive returns whilst lower quality high yield credit ended the month down as the fall in oil prices shook the asset class.

Grégoire Sharma

Alternatives & FX

• Oil fell for the second month in a row with a loss of more than 13%, totalling a near 29% decline thus far for 2020. This was fuelled by concerns surrounding the coronaviruses negative effect on global economic growth – slowing demand for industrial metals further escalated concerns.

• Commodity based currencies – AUD, CAD & NZD, all saw large declines as investors feared the potential downside in economic growth. The pound followed the trend and declined across the board as Brexit trade negotiations caused further uncertainty.

Harry Elliman

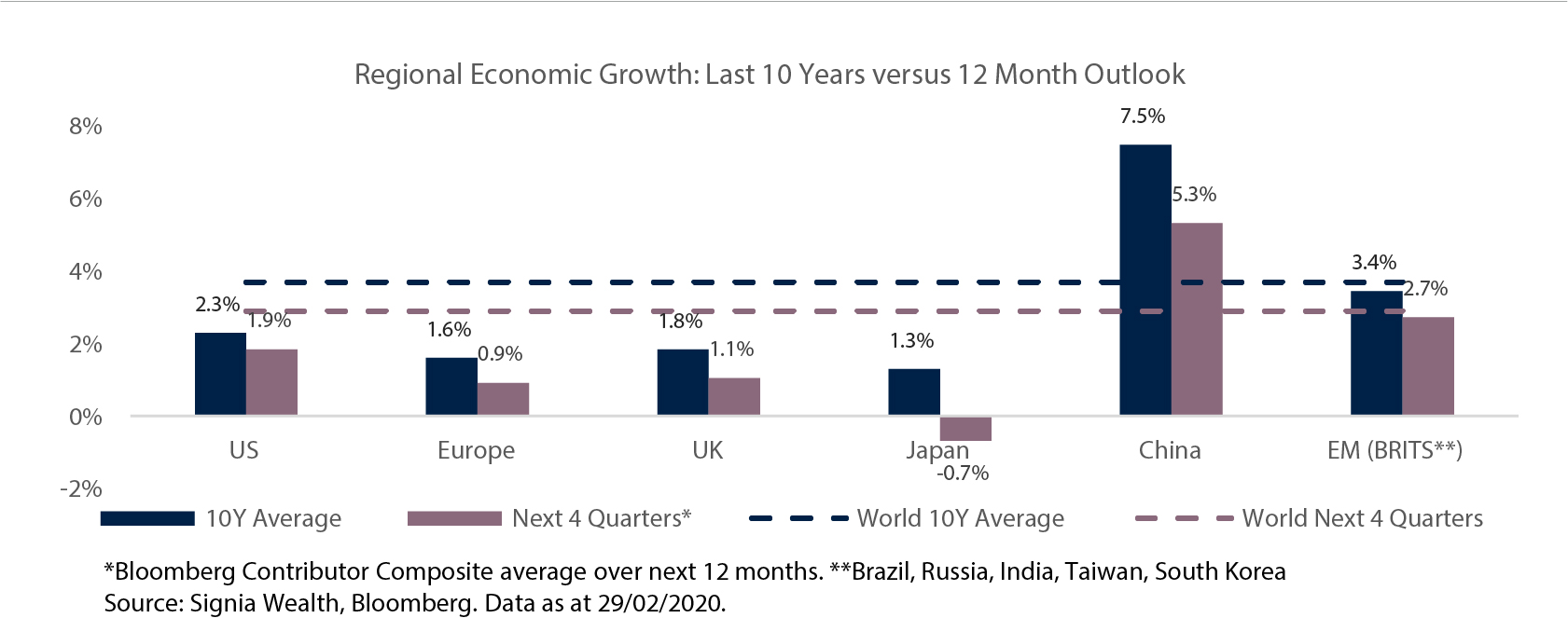

Regional Economic Growth: Last 10 Years versus 12 Month Outlook

Choose a Service to Invest through

United States of America

The US economy is running around long-term trend growth after the Federal Reserve cut interest rates three times last year. Domestic consumers and household balance sheets are in a healthy state, but strong labour market momentum is slowing and corporate sector leverage is rising. 2020 recession risk is still low but is rising as the coronavirus epidemic spreads, impacting China-based manufacturing supply chains as well as service sectors such as travel and tourism.

Europe

Economic indicators remain weak below long-term trends, led by German and Italian near-recessions, whilst heightened economic uncertainty has caused a decline in real investment and business expectations. The ECB remains committed to a supportive policy stance and expanding its balance sheet to fight declining inflation expectations, however, any economic recovery this year will likely be contingent on a rebound in global trade and manufacturing.

United Kingdom

Business sentiment and forward looking economic indicators have rebounded following a resounding Conservative Party win in the general election, however monetary policy remains tied to a Brexit trade agreement with the EU and economic uncertainty will likely persist this year despite a relatively upbeat labour market. Profit growth and business confidence remain depressed and are weighing on the value of the British Pound.

Japan

The economy is still digesting a consumption tax hike in October but is now also having to contend with a hit from coronavirus-related supply chain issues across Japan’s critical manufacturing sector. With very low market expectations for Japanese economic growth in 2020, the bar has been set very low for an economic recovery, which still remains possible in H2 with a China recovery and an accommodative BoJ that is committed to supporting financial conditions.

China

Expectations for economic growth this year have been revised down by 0.5% as policymakers stand firm in their support to stimulate the economy whilst containing the coronavirus outbreak and ending a four-week economic shutdown. Following a phase one trade deal the tariff drag on the economy from the trade war with the USA has started to dissipate after causing 2019 growth to decelerate towards the lower end of the policymaker’s target range of 6-6.5%.

Emerging Markets

EM central banks have joined the US Federal Reserve in easing financial conditions and providing much needed support for emerging market asset prices in a slowing global growth and strengthening US Dollar environment. China-reliant economies in Taiwan and South Korea have been hit the hardest by the coronavirus outbreak and will most likely take longer to recover this year.

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.