Top 10 Investment themes for 2021

It is safe to say that even the most skilled and confident investors that started this decade with perfect 2020 vision of the markets would have been blindsided by what swiftly unfolded in the first three months of it.

The Coronavirus Crisis will undoubtedly be remembered by generations to come as a stark reminder of how interconnected and vulnerable the human race has become to an infectious disease, but also for its collective solidarity and reactive capacity of its policy and vaccine response.

Looking ahead, 2021 may well mark the beginning of the end for the COVID-19 pandemic. The combination of recovering world economic growth, benign inflation and loose monetary policy is about as good a macro backdrop as it gets for risk assets, but we acknowledge that some of this 2021 optimism has already been priced into 2020 asset valuations, and so we remain balanced in our approach and focused on high conviction themes, sectors and market segments where opportunities persist.

1. Global V(accine)-Shaped Recovery

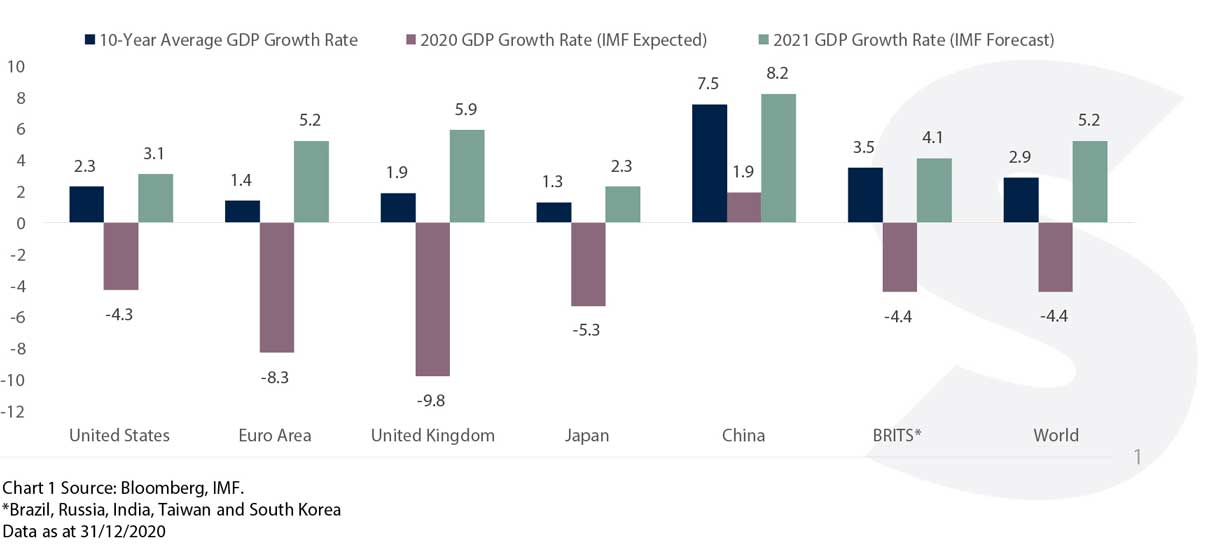

Our core investment thesis for 2021 is centred around a strong but uneven global V-shaped economic recovery, as multiple vaccines are distributed worldwide and economic output expands at a faster pace relative to long-term growth rates.

With the notable exceptions of China, Taiwan, Indonesia and Vietnam, the International Monetary Fund (“IMF”) forecast that most world economies will only partially recover from their deep 2020 recessions. The output of the advanced economic block consisting of the US, Euro Area, UK and Japan, which contributes roughly half of world GDP, is expected to end 2021 still 3% below its 2019 level. China on the other hand is expected to grow by over 10% above its 2019 level, however, with such high market expectations and a languishing world ex-China economy, we believe the prospect for above consensus Chinese growth in 2021 is unlikely.

World Economic Growth Outlook (YoY %)

2. Renewed Reflationary Support from Policymakers

The 2010s was the first decade on record where most advanced economies avoided a recession, now at the turn of the 2020s these same economies have registered their deepest peacetime recessions on record.

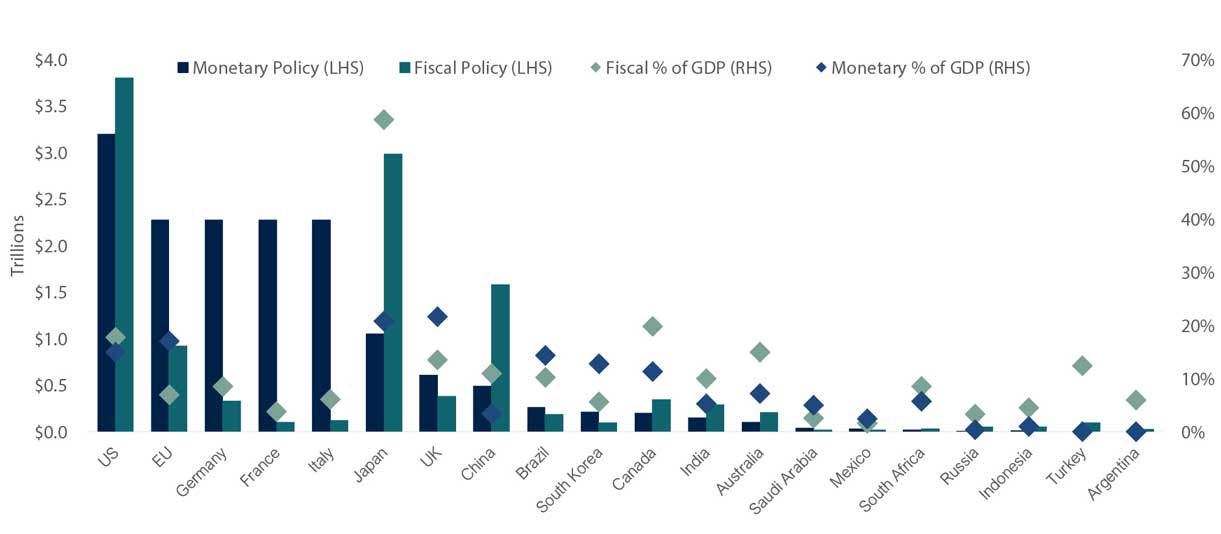

Unsurprisingly then, the global monetary and fiscal policy response to the pandemic has been truly unprecedented in size and scope. Central banks in developed markets expanded their collective balance sheet to more than 50% of GDP. The Federal Reserve (“Fed”) led the way by expanding its balance sheet by 75% to an eye-watering $7.4 trillion to keep the financial system afloat and is expected to add another $1.4 trillion in 2021.

The US fiscal response was equally impressive adding $3.8 trillion of stimulus to help bridge household income gaps. In total, G20 policymakers committed a staggering $20 trillion or 27% of collective GDP in their 2020 pandemic response. We expect the main central banks to remain accommodative without any rate hikes for at least the next few years.

The G20 Pandemic Response in 2020 Has Been Remarkable

Choose a Service to Invest through

3. Higher Inflation but Not High Inflation

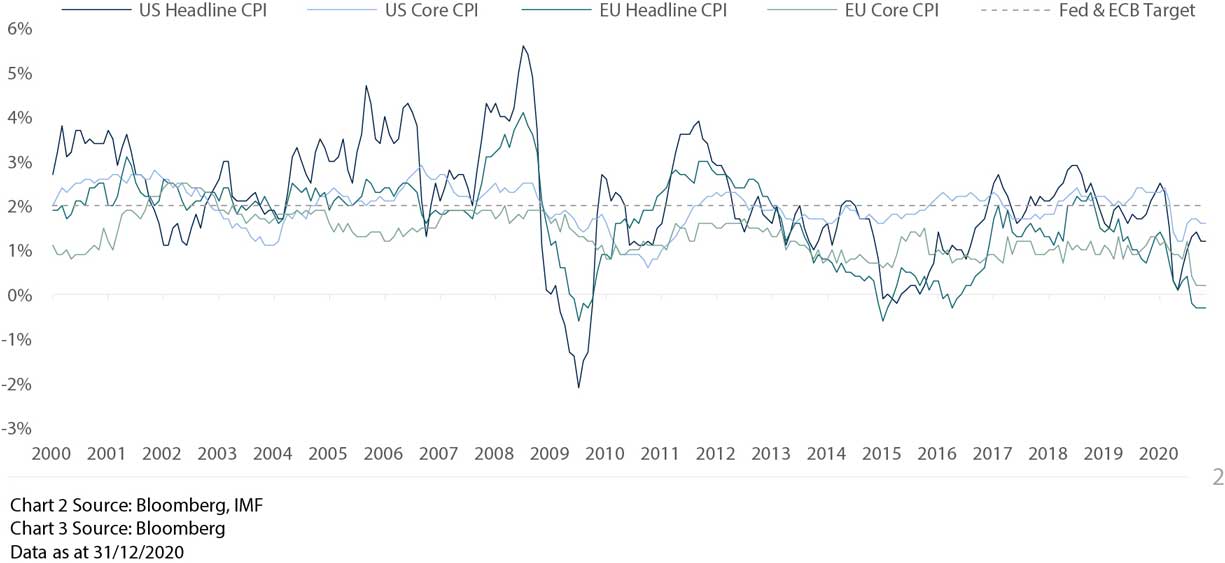

The case for high inflation has been strongly debated over the last dozen years since the collapse of consumer prices during the 2008 great financial crisis, since then inflation has recovered but has been broadly on a downward trend. It has taken a trillion euros of asset purchases by the European Central Banks (“ECB”) to combat the Coronavirus Crisis and prevent European inflation expectations entering a deflationary spiral.

Despite this, inflation options pricing still suggests the likelihood of chronic lowflation (price increases of less than 1%) has almost doubled since the start of the pandemic with investors now increasingly betting on ‘Japanification’ of Europe, as a wide margin of economic slack coming out of the crisis is likely to curb wage growth and pricing power for a considerable period of time.

To help address this risk the US Fed committed in 2020 to overshoot its 2% inflation target in the near-term by instead focussing on long-term average inflation targeting – strategic discussions at the ECB may lead to a similar outcome in 2021 – however, we expect this will continue to be an elusive objective for them to achieve.

Inflation Has Mostly Been Below Target Since The GFC

4. US Dollar Down But Not Out

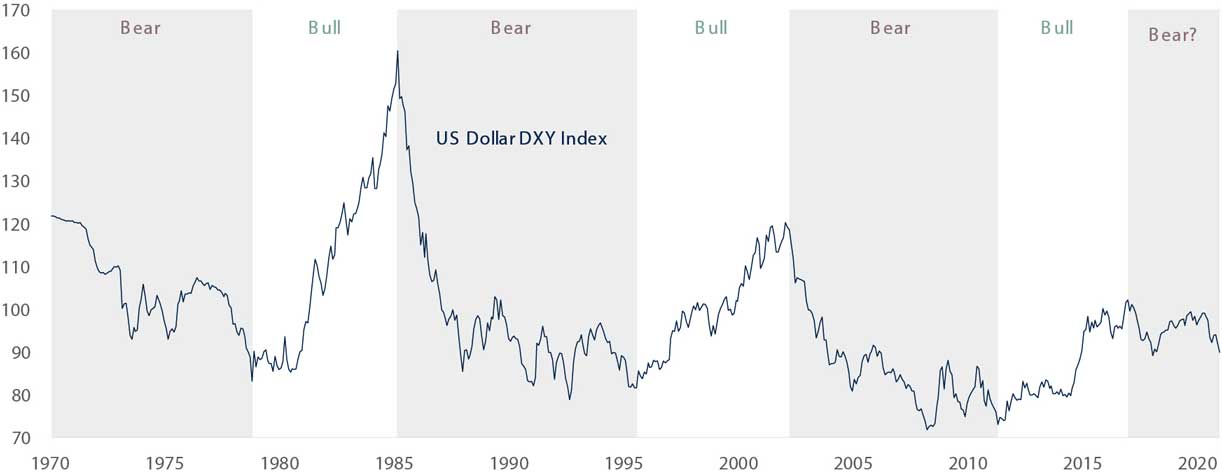

As the world’s reserve currency the strength of the US Dollar has been paramount in shaping the global macroeconomic backdrop. Two-thirds of all global securities are denominated in US Dollars with the greenback also acting as a monetary anchor linked to the currencies of countries accounting for two-thirds of world GDP. Thus, a stronger US Dollar tightens global financial conditions by increasing the cost of dollar-denominated debt issued by foreign countries and companies, applies upward pressure and stress to foreign linked currencies, and makes dollar-denominated commodities more expensive.

It is understandable then that the direction of the US Dollar tends to dictate the risk appetite of investors and moves inversely with the direction of the market cycle. Following the nadir of the March pandemic last year the US Dollar has weakened by 12% against the world’s major currencies as global equity markets recovered. We expect this trend to continue in 2021, albeit to a lesser extent, as the global economic recovery accelerates.

The US Dollar Has Been In Structural Decline Since The 80s

5. Brexit Begins, Sterling Strengthens

The UK avoided a hard Brexit at the eleventh hour on Christmas Eve before the end of the transition period on 31 December 2020, agreeing a partial deal with the EU to prevent tariffs and quotas on bilateral trade in goods, however the deal fell short with the exclusion of important sectors such as financial and professional services.

The ongoing Brexit uncertainties have added to the painful economic impact on the UK from the Coronavirus Crisis, with the British economy one of the worst affected in the world, contracting by over 21% in the first half of 2020 and only partially recovering. Despite this, Sterling had mixed fortunes in 2020, rising 2.9% against the US Dollar but falling 5.5% in value against the Euro.

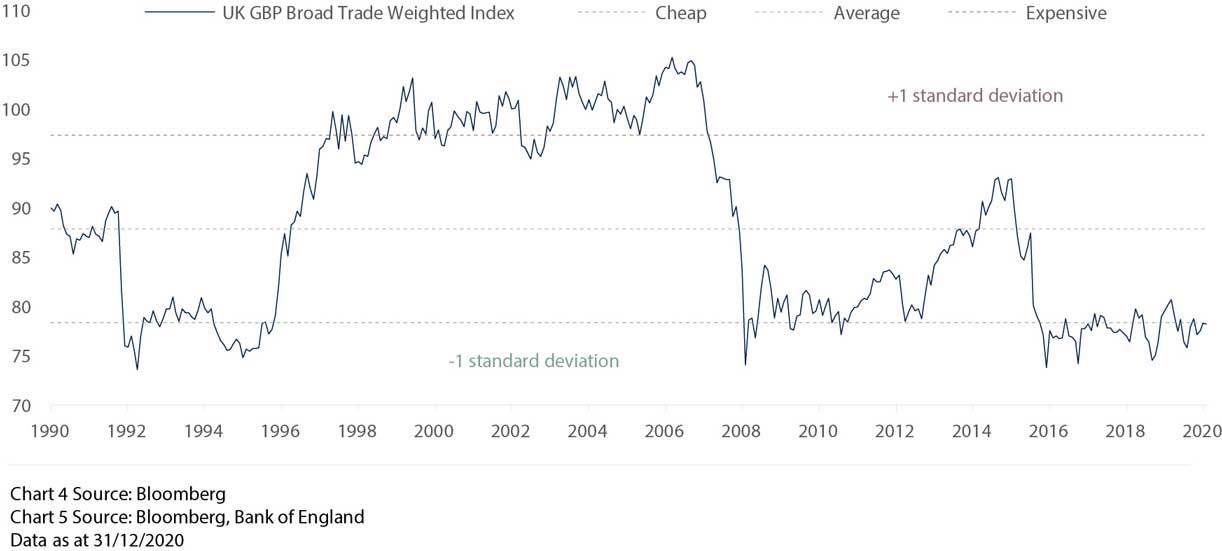

On a trade-weighted basis Sterling is still substantially cheap, and looking back 30 years reveals that it is still valued one standard deviation below its long-term average. We expect a slow strengthening from here as negative Brexit tail risks fade and the UK vaccination programme leads the way.

Sterling Remains Historically Cheap After Brexit

6. Treasury Yields Inch Higher, Curve Steepens

We expect a broad but moderate rise in global bond yields in 2021 as two competing forces shape the markets. An accelerating global economic recovery and rising inflation expectations will likely put upward pressure on yields, whilst continued central bank bond buying and economic scaring from the Coronavirus Crisis – such as structurally higher unemployment levels – will likely keep yields relatively contained and prevent a quick return back to 2019 levels.

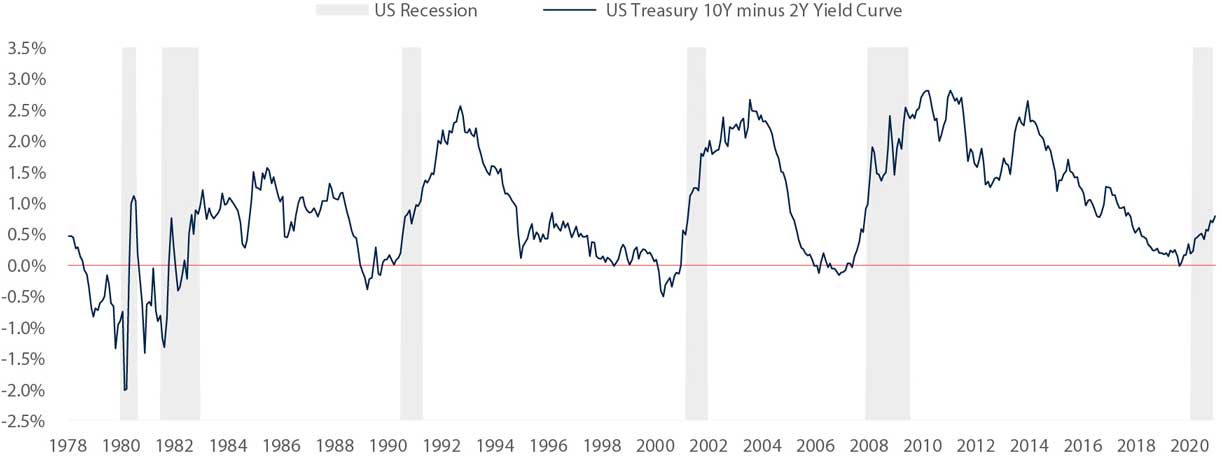

Following a very strong year of outperformance within the global bond universe in 2020, we expect US Treasuries to underperform this year as the prospect for higher fiscally-driven growth and inflation in 2021 has increased by the recent election of a Democratically aligned Congress. This should continue to support a steepening yield curve, as measured by the US 10-year bond yield minus the US 2-year bond yield, as long-term bond yields rise alongside inflation expectations and short-term bond yields remain anchored by the Fed.

The US Yield Curve Has Historically Steepened During And After A Recession

7. Cyclical and European Stocks Outperform

Whilst the COVID-19 pandemic caused widescale and indiscriminate economic disruption across the world in 2020, it had a much larger and damaging impact on the revenue streams and business models of some companies and sectors over others.

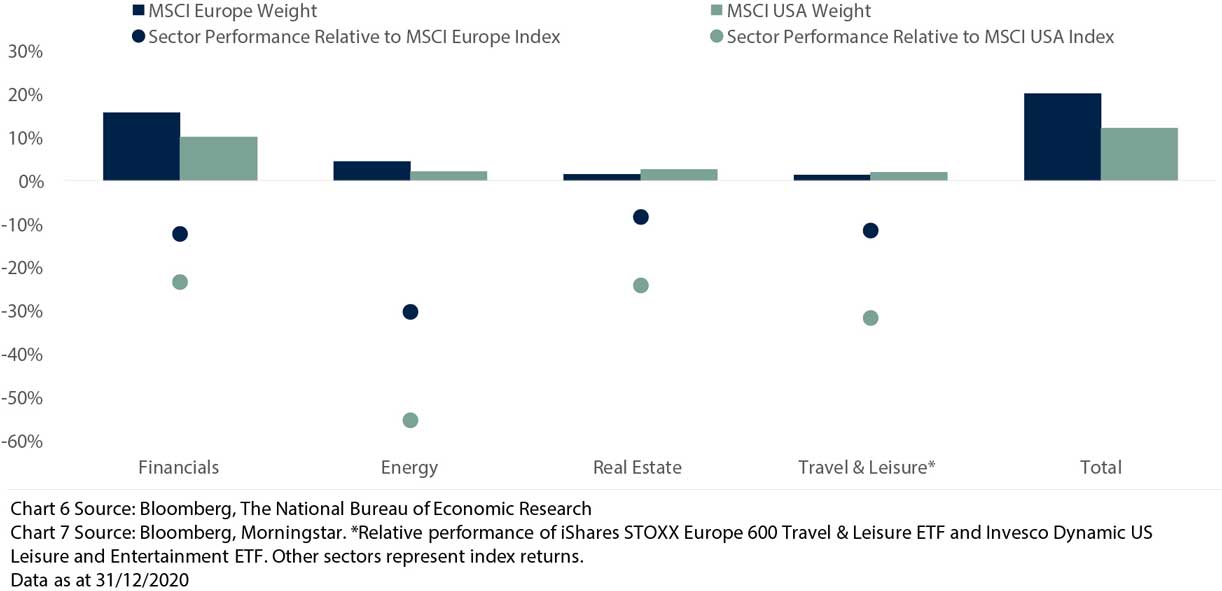

Cyclical companies with a stronger connection to the economic cycle that were not able to benefit from the substantial pickup in online consumer spending during nationwide lockdowns were hit the hardest, with travel & leisure, commodity and real estate sectors amongst the worst affected.

Financial stocks also underperformed as overall consumer spending decreased and interest rates were cut to zero, reducing the profitability of banks. These cyclical sectors are meaningful market segments, accounting for 20% and 12% of the MSCI Europe and USA Indices, respectively. With the prospect for rising bond yields and high household savings rates fuelling a consumer spending binge later in 2021, we expect these beaten up sectors to outperform.

Cyclical Companies Have Been Worst Hit By The Pandemic

8. Emerging Markets’ Time To Shine

Emerging economies have found themselves in a perfect economic storm during the pandemic. From the global economic “sudden stop” and the geographically uneven recovery that followed, many have seen export revenues collapse, tourism earnings disappear and foreign direct investment evaporate. Yet, quite remarkably the vast majority of emerging markets avoided debt defaults and significant restructurings in 2020, leading to further evidence that on the whole they have started this decade in a fundamentally healthier position than they did last decade.

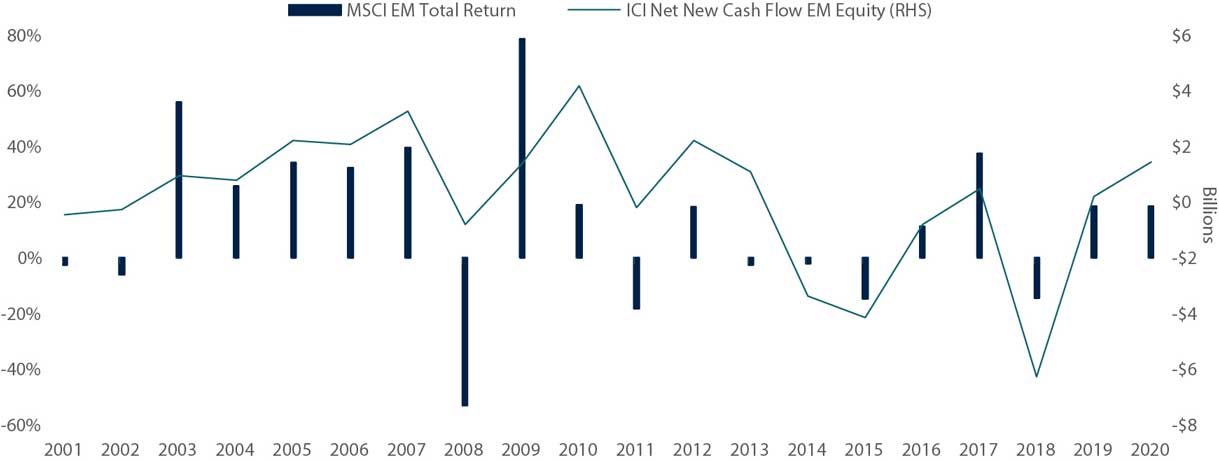

This partly explains why cash flows into emerging market equities, alongside average returns, were lower in the 2010s compared to the 2000s. Indeed, with liquidity quickly returning to financial markets amidst a weak US Dollar environment, and investors searching aggressively for greater yields and attractive valuation discounts, we expect EM cash flow trends to move structurally higher and for relatively cheap EM equities to outperform.

Emerging Market Returns And Capital Flows Have Declined Since The GFC

9. The Case for Gold Evolves, Demand Persists

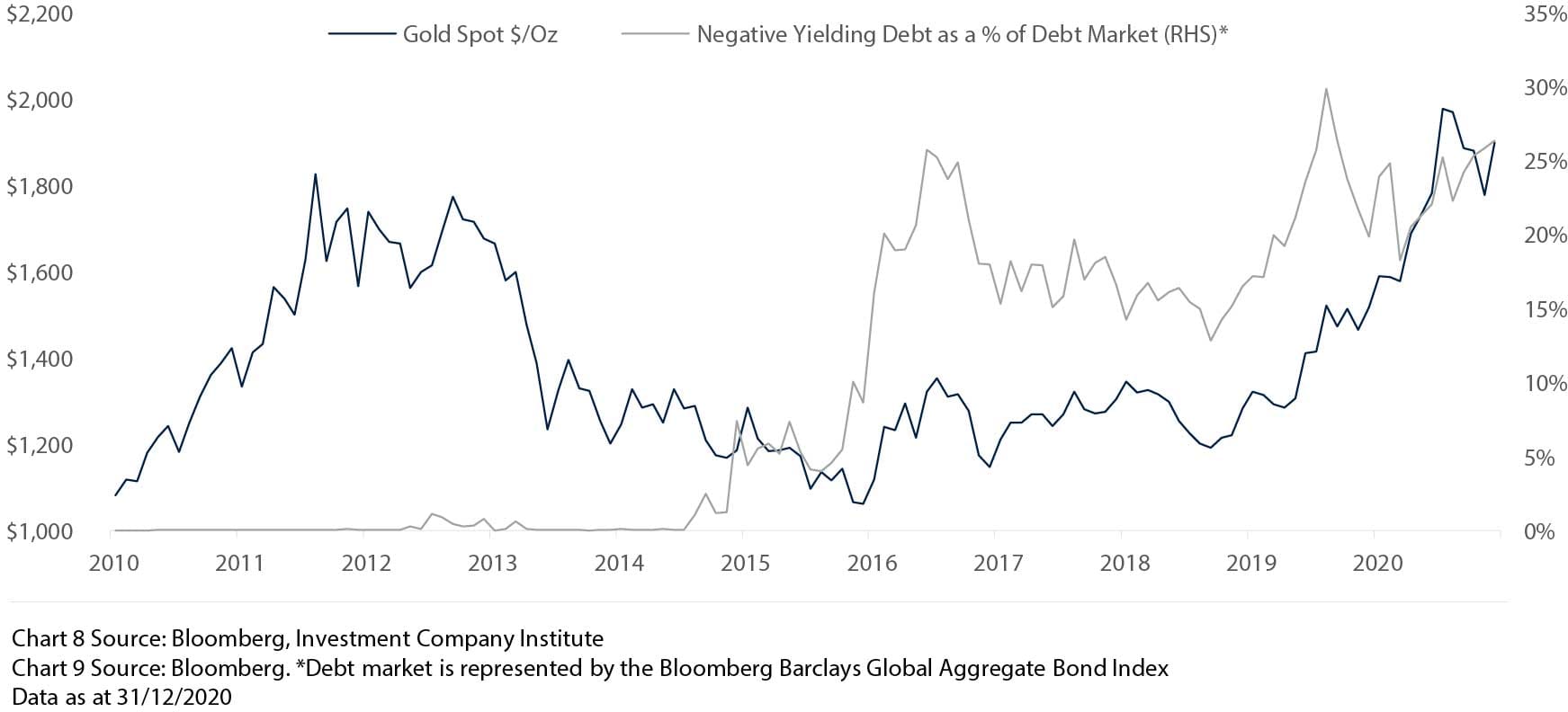

Since the ECB cut their deposit facility rate into negative territory in 2014 (currently -0.5%) the stock of negative yielding global debt in the financial system has increased considerably from zero to 26% at the end of 2020. Contributing to this over recent years has been the Fed’s loosening cycle which has seen the central bank cut its base interest rate range from a peak of 2.25%-2.5% in June 2019 to 0%-0.25% as at the end of 2020.

Over the same time period the price of gold has risen by 34% from $1409 to nearly $1900. Whilst there is no direct correlation between the two, in a world of low and negative interest rates and bond yields, savers and investors in certain pockets of the fixed income markets are left with little choice but to search elsewhere for safe haven assets and a store of wealth. After all, an investment in gold with a zero yield is currently yielding up to 0.5% more than a Euro deposit! As global bond yields gradually rise from their near zero bound in 2021 we expect gold’s appeal to savers and its diversification benefits to investors to persist, and demand for gold bullion to remain strong.

The Opportunity Cost Of Holding Gold Has Declined Alongside Bond Yields

10. Investors Change for Climate Change

Before coronavirus was a common household word, one of the key concerns for investors in early 2020 was the growing impact and unrest from global climate change.

In January, before the pandemic unfolded, Australia was engulfed in flames as it experienced its worst bushfire season on record with 126,000 square kilometres of land and thousands of buildings destroyed, and registering the world’s worst wildlife disaster in modern history with nearly 3 billion animals affected. Disturbingly, these types of headlines are becoming increasingly frequent as climate change incrementally impacts our world more and more each year.

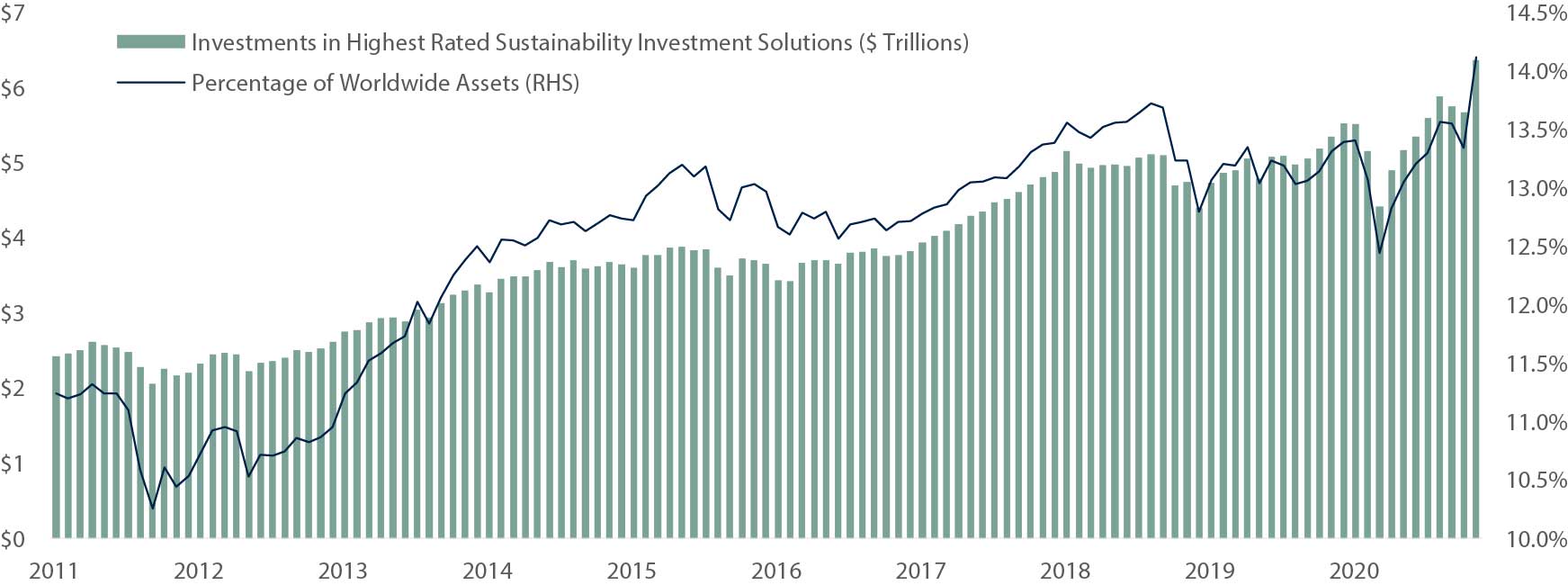

Despite the Coronavirus Crisis causing a drop in carbon emissions last year, 2020 was still the warmest year globally on record, tied with 2016. It will take many years, if not decades, to stop the rise in global temperatures if the world pulls together. Investors are certainly playing their part, increasing their capital allocated to the highest rated sustainability investments* to $6.4 trillion in 2020, or over 14% over total worldwide assets** reflecting the growing importance of sustainability mandates in the global financial system and overall changing attitudes towards climate change

Demand For Sustainable Investments Is Growing, Alongside Market Share

2021 Market Summary

In conclusion, we expect 2021 to be a more positive and stable year for the global economy as it recovers from its abrupt 2020 shock. However, whilst we are also positive on risk assets this year we do not expect the strength of the market response to match that of the improving economic data.

Despite declining by -32% from peak to trough in February and March as the coronavirus spread across the world, global equities went on to stage an impressive, yet disconnected, recovery in 2020 ending the year up +14%, whilst many world economies were left languishing in further lockdowns as infections continued rising. We start 2021 cognisant of this and the fact that whilst some equity markets are still cheap, equally some are now expensive.

Nonetheless, we believe investors should remain focused on these top ten themes for 2021 as the combination of effective vaccination programmes, continued reflationary support from policymakers, and a broadly benign inflationary backdrop, have the potential for sustaining the powerful financial wave that has lifted all boats.

Robert Lee

Co-Head of Multi-Asset Investments

Jack Rawcliffe

Senior Equity Fund Analyst

Harry Elliman

Investment Analyst

Important Information

The information set out in this document has been provided for information purposes only and should not be construed as any type of solicitation, offer, or recommendation to acquire or dispose of any investment, engage in any transaction or make use of the services of Signia. Information about prior performance, while a useful tool in evaluating Signia’s investment activities is not indicative of future results and there can be no assurance that Signia will generate results comparable to those previously achieved. Any targeted returns set out in this document are provided as an indicator as to how your investments will be managed by Signia and are not intended to be viewed as a representation of likely performance returns. There can be no assurance that targeted returns will be realised. An estimate of the potential return from an investment is not a guarantee as to the quality of the investment or a representation as to the adequacy of the methodology for estimating returns. The information and opinions enclosed are subject to change without notice and should not be construed as research. No responsibility is accepted to any person for the consequences of any person placing reliance on the content of this document for any purpose. No action has been taken to permit the distribution of this document in any jurisdiction where any such action is required. Such distribution may be restricted in certain jurisdictions and, accordingly, this document does not constitute, and may not be used for the purposes of, an offer or solicitation to any person in any jurisdiction were such offer or solicitation is unlawful. Signia Wealth is authorised and regulated by the Financial Conduct Authority.